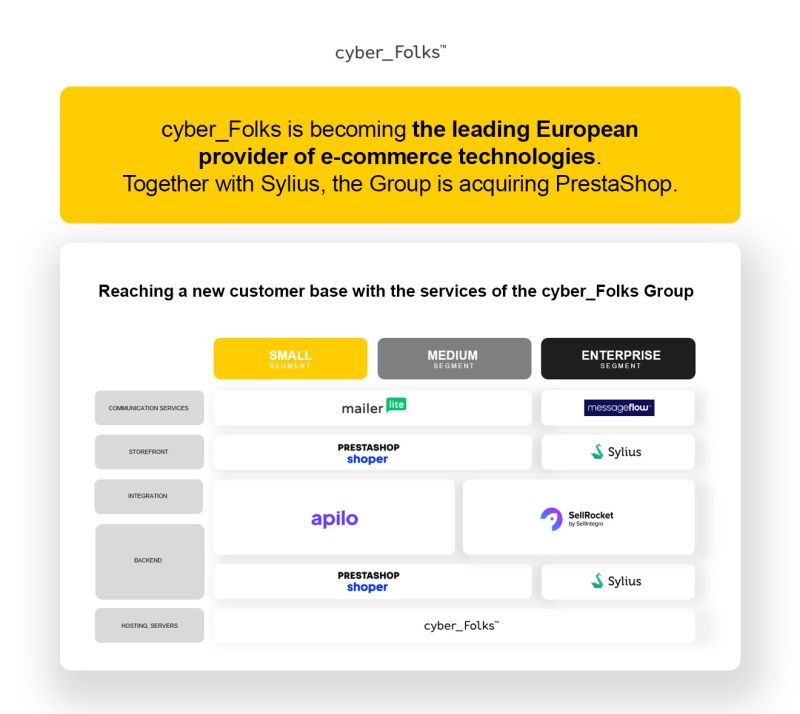

The acquisition of PrestaShop by the cyber_Folks Group, executed together with Sylius, marks one of the most consequential shifts in the global e-commerce technology stack in recent years. PrestaShop, with more than 230,000 active stores and €22B in GMV, has long been a foundational engine for online retail across Europe, LATAM, Africa and emerging markets. Its transition into a new ownership structure introduces a rare moment in which the application layer – rather than infrastructure becomes the centerpiece of industry consolidation.

For the hosting and cloud sector, this transaction carries weight far beyond the software world. PrestaShop has historically driven hosting demand at scale: shared hosting environments, VPS fleets, managed instances, containerized deployments and customised cloud setups are tightly coupled with the platform’s architecture. The new ownership unifies PrestaShop with two other major commerce layers: a SaaS engine and a composable headless framework. Together, these create a vertically integrated ecosystem that influences not just how merchants sell, but where their workloads run and how infrastructure providers must adapt.

The combined GMV of the post-transaction ecosystem approaches €35B, putting it in a comparable range with Shopify’s European exposure. But the strategic consequence is less about size and more about control of the entry points into infrastructure consumption. Merchants choosing between SaaS, open-source or headless solutions will now be navigating within a single technology family capable of guiding their migration path, lifecycle, scaling model and operational footprint.

From the workload perspective, this convergence is significant. PrestaShop continues to generate large volumes of PHP-based traffic suited to classic shared and VPS hosting, while Sylius represents API-driven, container-friendly architectures characteristic of enterprise headless deployments. The SaaS component adds a high-density, centrally managed layer that concentrates infrastructure into optimized clusters. For cloud providers, this means new patterns of demand: mixed LAMP workloads, API-on-edge traffic, queue-heavy asynchronous operations, and periodic high-throughput e-commerce peaks consolidated into a single ecosystem rather than scattered across independent vendors.

For integrators and managed service providers, the implications are equally notable. A unified stack across SaaS, open-source and headless removes friction in merchant lifecycle management. Instead of losing customers to incompatible platforms when they outgrow one model, partners can maintain continuity across the same family of technologies. This strengthens retention, reduces platform switching costs and creates clearer specialization paths – from SMB onboarding to enterprise composable architectures.

From an M&A standpoint, the acquisition signals a shift in priority. For a decade, consolidation in hosting largely focused on infrastructure: data centers, hosting brands, reseller portfolios, VPS stacks and domain bases. The PrestaShop acquisition demonstrates a different thesis: the highest-leverage assets in today’s market are the application platforms that define where workloads land. Owning the software layer means owning the decision-making point that precedes infrastructure spend. This is strategically more powerful than acquiring additional hardware capacity or local brands.

The transaction also highlights a structural trend across global e-commerce technology: open-source platforms retain strong influence in mid-market and emerging regions, where merchants require ownership, flexibility and independence from SaaS constraints. At the same time, enterprise demand continues shifting toward composable architecture. By combining PrestaShop, a SaaS engine and a headless framework, the new ecosystem spans all three layers without forcing merchants into one model — a capability that few global providers currently offer.

For cloud hosts and infrastructure providers, the takeaways are clear. The next phase of platform growth will not be decided by bandwidth or CPU pricing, but by control over the frameworks that merchants adopt. Hosting companies that integrate deeply with commerce platforms, provide optimized environments and build specialization around high-traffic workloads will capture disproportionate value. Those relying on generic infrastructure without application-layer alignment will increasingly compete on low-margin commodity resources.

The acquisition of PrestaShop is therefore not simply a software deal. It is a structural repositioning in which the power to shape infrastructure demand shifts upward – from hosts to the platforms that dictate how merchants build, scale and operate. In that sense, this move represents one of the most strategically significant transactions in the intersection of hosting, cloud and commerce technology in recent years.