TL;DR: We went through OVHcloud’s Q1 revenue update press release, the January 8 revenue deck presentation, and Investor Day materials to see what’s really changing and what isn’t.

Revenue is up, the plan hasn’t moved, and discipline is holding. But most of the growth comes from pricing, mix, and sweating the existing base, not from a broad pickup in demand.

Public Cloud is growing fast and Private Cloud still pays the bills. The business is stable, but momentum is still missing.

This marks a clear contrast to the tone of FY2024 and early FY2025, when OVHcloud results were framed around sustained high-single to double-digit growth and expanding momentum across both Public and Private Cloud, as we previously covered on webhosting.today.

What does it mean in detail?

OVHcloud’s Q1 FY2026 revenue update matters because it confirms a familiar but uncomfortable pattern. The company is executing well, keeping costs under control, and sticking to its plan. At the same time, growth remains slow and uneven, and the part of the business that pays the bills is under pressure.

For hosting and cloud executives, this update is a reminder that operational discipline alone doesn’t change outcomes. Q1 doesn’t show a company in trouble, but it also doesn’t show one that is building momentum.

What actually happened

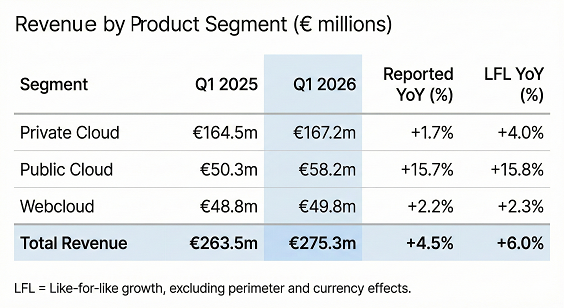

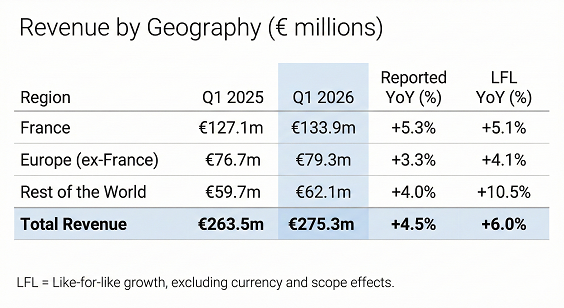

In its Q1 FY2026 revenue update, OVHcloud reported €275.3 million in revenue, up 6% year over year. This figure reflects actual revenue generated during the quarter ended in November 2025 and is consistent with recent quarters and management’s expectations.

Why this matters:

- 6% growth is enough to keep the business stable,

- it is not enough to close the gap with faster-growing competitors or materially change market perception.

Management also reaffirmed its full-year FY2026 guidance:

- 5–7% organic revenue growth,

- CapEx at 30–32% of revenue,

- positive levered free cash flow by year-end.

Taken together, the update confirms that OVHcloud is continuing with a conservative strategy focused on cost control and cash generation rather than pushing for faster growth.

What didn’t happen

Just as important, this revenue update did not introduce any new signals about a change in the business trajectory.

Based on what management disclosed there are no signals of:

- growth acceleration,

- demand conditions,

- change in the planned revenue mix.

Basically, the update did not reset expectations or point to a shift in strategy. It confirmed that the business is performing in line with the existing plan and that the plan itself remains unchanged.

Where the pressure really is

The headline growth number masks very different dynamics across OVHcloud’s product lines.

Public Cloud grew 15.8%

This remains the fastest-growing segment and the only part of the business where clear volume-driven growth is visible, supported by customer acquisition and expanding usage. However, Public Cloud represents only about 21% of total group revenue. Even at double-digit growth, it is still too small to materially lift the company as a whole.

Private Cloud grew 4%

This is the core of OVHcloud, accounting for roughly 61% of revenue. Management explicitly acknowledged customer churn in the Corporate segment. Customers are downsizing clusters, delaying renewals, and moving predictable workloads off Private Cloud to reduce costs. Revenue continues to grow, but at a modest pace.

Web Cloud grew 2.3%

This segment remains largely flat. It is stable, but it is not contributing meaningfully to growth.

Net revenue retention of 105% reinforces this picture. Existing customers are generating more revenue year over year, which helps offset churn and slower acquisition in parts of the core business. Growth is being sustained primarily through higher spend per customer and mix effects rather than broad expansion in customer volumes.

What OVHcloud is choosing to prioritize

The revenue update reinforces that OVHcloud is prioritizing financial discipline over aggressive expansion.

The company plans to meet its objectives by:

- holding CapEx tightly,

- generating cash from existing infrastructure,

- avoiding large, risky investments.

At the same time, OVHcloud continues to:

- roll out new 3-AZ public cloud regions,

- advance AI inference initiatives through its SambaNova partnership.

Both initiatives require capital. Based on the update and longer-term disclosures, OVHcloud is funding these efforts by increasing utilisation of existing datacenters, extending the life of Private Cloud hardware, and limiting upgrade cycles. This approach supports cash flow and margins, but it also limits how quickly the company can close the gap with competitors that continue to invest aggressively in scale and capacity.

What this means for the hosting market

This update reinforces a clear message for the industry: playing defense is not enough. When a core product grows at 4% while leading competitors grow at 20% or more, cost control buys time, but it does not change competitive positioning.

OVHcloud’s sovereignty positioning remains credible and increasingly validated. Regulated workloads and public-sector demand continue to support the business. The issue is scale. These wins improve credibility, not the overall growth rate.

AI remains a positioning signal rather than a material revenue driver. Until it contributes meaningfully to revenue, it does not change the underlying economics reflected in this update.

Bottom line

OVHcloud’s Q1 FY2026 revenue update confirms a business that is stable, disciplined, and executing within its stated framework. The platform works, margins are being protected, and cash generation is improving.

At the same time, growth remains weak where it matters most. Private Cloud is under pressure, and while Public Cloud is growing fast, it is still too small to change the overall picture.

This update confirms a holding pattern, not a turnaround. The next real test will come with the H1 FY2026 results, when margins, cash generation, and capital intensity will be disclosed alongside revenue.

Damian Andruszkiewicz

Author of this post.