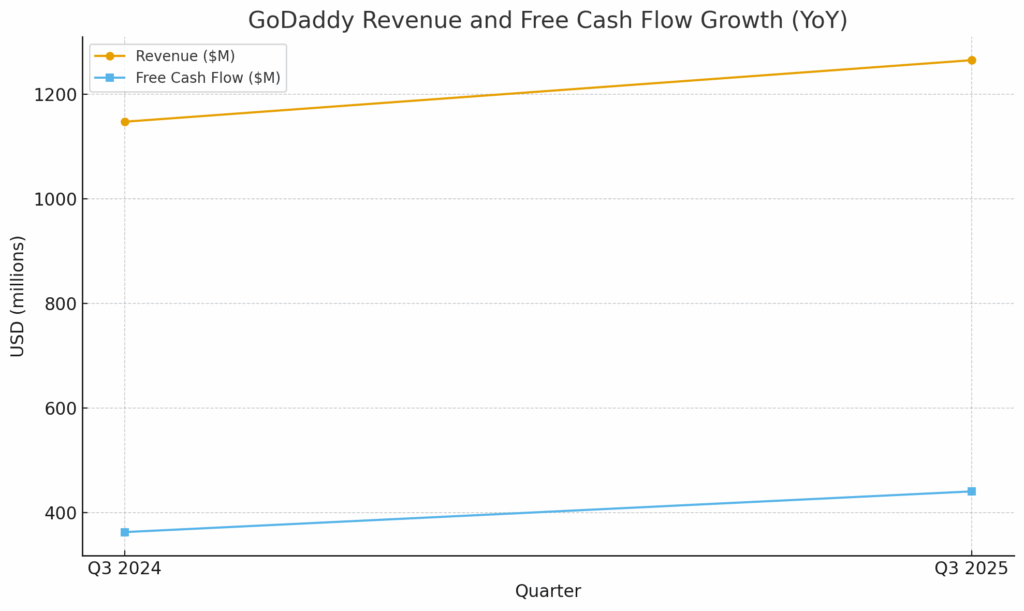

GoDaddy’s third quarter 2025 results show a company that continues to balance growth, profitability, and technological transition with discipline. Total revenue reached $1.3 billion, representing a 10% year-over-year increase, while operating income rose 17% to $296.7 million. The company’s free cash flow climbed to $440.5 million, up 21% from the same period last year.

This consistent performance underscores a business model that is durable even as GoDaddy reinvests in new capabilities. Both core hosting and domain services, as well as its Applications and Commerce division, contributed to results. The A&C segment, which includes e-commerce and marketing tools, grew 14%, while the Core Platform grew 8%.

GoDaddy’s CFO Mark McCaffrey described the company’s focus as “disciplined execution and operational efficiency” — an approach that seems to be paying off as margins improved and recurring revenue continued to grow.

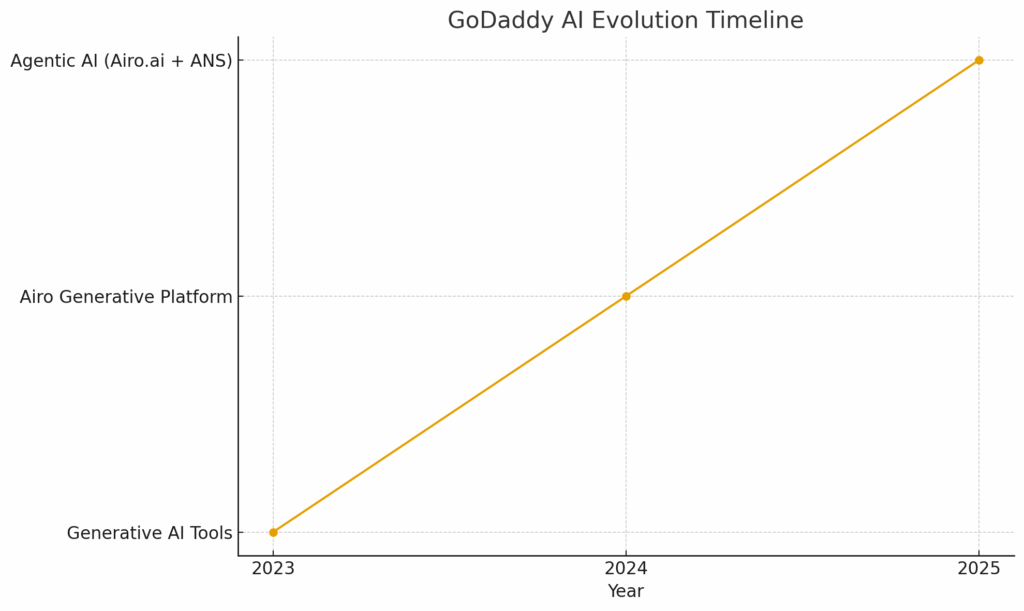

From generative AI to agentic AI: GoDaddy’s next strategic phase

Beyond the financials, GoDaddy used its Q3 update to clarify a shift in how it is integrating artificial intelligence into its ecosystem. The company has evolved its Airo platform from a generative AI assistant to a new Agentic AI framework. This change represents a move away from one-off content generation toward autonomous, task-oriented agents that perform continuous actions for customers — for example, optimizing a small business website, managing online listings, or launching targeted campaigns.

These new capabilities are already live at Airo.ai, a dedicated environment for testing and deploying agent-based solutions. At the same time, GoDaddy introduced the Agent Name Service (ANS) — an identity protocol for AI agents built on the company’s DNS infrastructure. ANS enables secure discovery and verification of agents across the open web, effectively extending GoDaddy’s long-standing domain trust model into the next phase of the internet.

For hosting industry executives, this signals a deeper trend: AI is moving from generating marketing copy to managing online operations. GoDaddy is positioning itself as both a service provider and a standards-setter in this emerging “agentic internet.”

Financial discipline, strong liquidity, and a confident outlook

GoDaddy’s balance sheet remains solid. As of September 30, the company held $923.7 million in cash and equivalents, against $3.8 billion in total debt, resulting in a net debt position of $2.9 billion. Year to date, GoDaddy repurchased 9 million shares for $1.4 billion, signaling continued confidence in long-term cash generation.

Hosting M&A Consultation

Get one-on-one advice on maximizing your hosting company’s valuation and navigating the sale process.

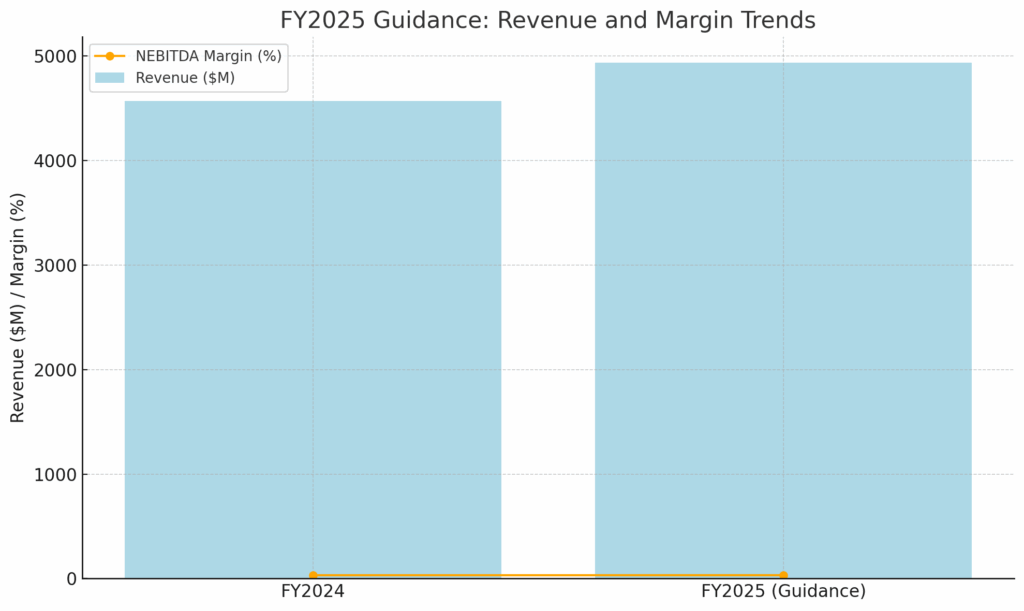

Looking ahead, management raised full-year 2025 revenue guidance to a range between $4.93 billion and $4.95 billion, implying around 8% annual growth. The company expects free cash flow to reach approximately $1.6 billion, up from $1.4 billion last year.

These numbers matter not because of their short-term appeal, but because they demonstrate that GoDaddy’s growth in AI-driven products does not come at the expense of financial discipline. The company is balancing innovation with efficiency — a model that hosting and cloud service operators can view as a benchmark for managing transformation at scale.

Summary of Q3 2025 report

GoDaddy ended the quarter with a steady mix of financial growth, operational control, and forward momentum in AI. Revenue rose 10%, free cash flow increased 21%, and the company expanded its margins while introducing two significant AI initiatives: the Airo Agentic Platform and the Agent Name Service (ANS). For decision-makers in hosting and internet services, the takeaway is straightforward: GoDaddy is executing on both profitability and platform evolution — setting a practical example of how to modernize legacy infrastructure without overextending on innovation risk.