Domain names are the cornerstone of online presence and brand identity, serving as the web addresses we enter to visit websites. Particularly, .com and .net domains stand out as symbols of credibility and professionalism in the digital landscape. Originally, .com indicated commercial ventures, quickly becoming a mark of business establishment, while .net, aimed at network infrastructure, evolved into a versatile choice for various online projects. Their significance in the digital age is immense, making them highly sought after by businesses, entrepreneurs, and creatives for their recognized value and impact in the vast expanse of the internet.

A Decade of Growth and Pricing Dynamics

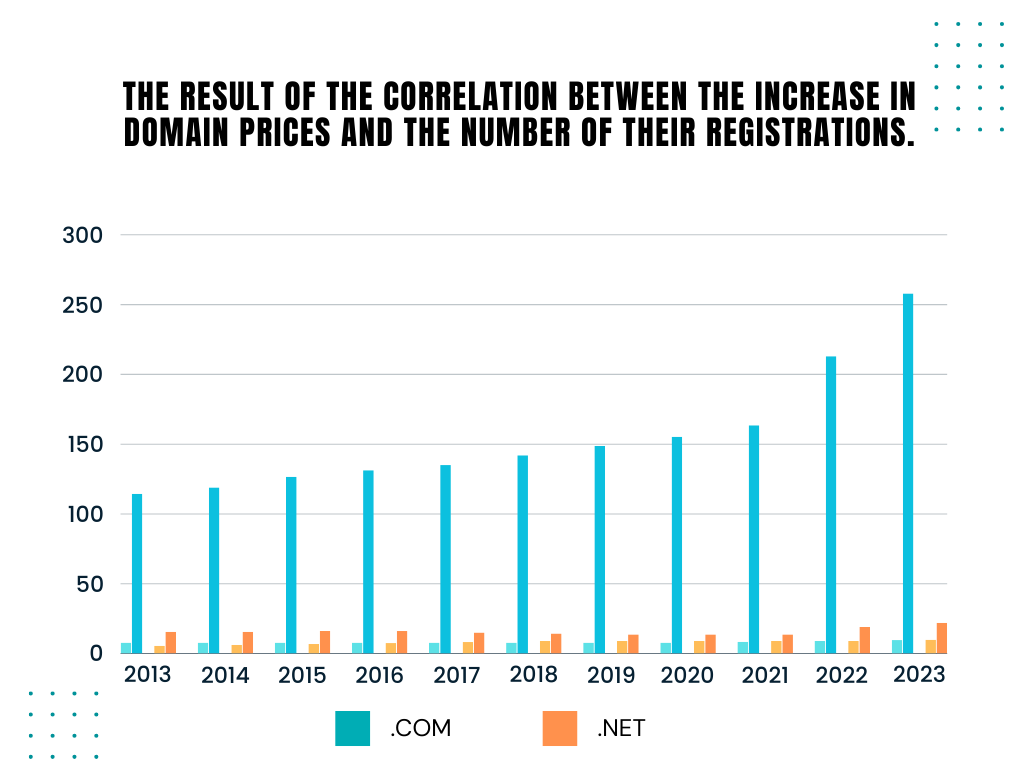

In the last ten years, the landscape of domain registrations has undergone considerable shifts. By charting the evolution of .com and .net domains from 2013 to 2023, we can uncover the intricate dynamics that not only reflect the growth in demand for online presence but also the changes in registration prices that have accompanied this growth. Understanding this interplay is critical, as it offers valuable insights into the internet’s broader economic and technological trends.

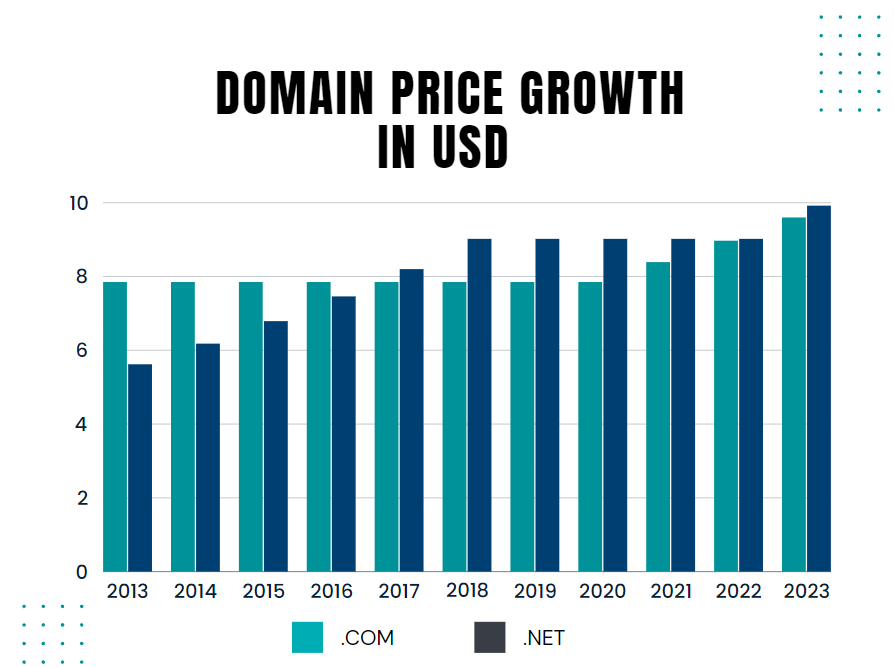

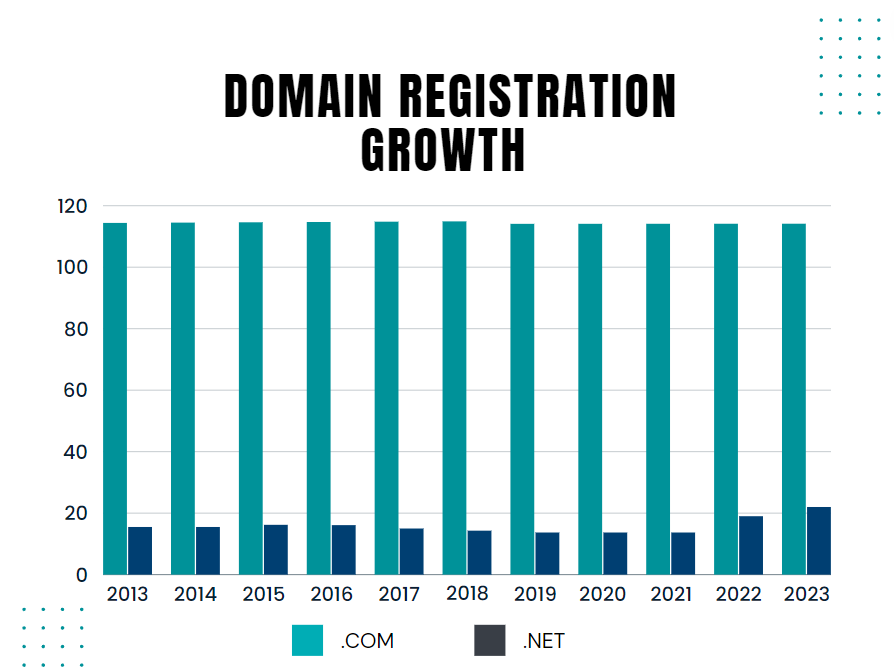

| Year | Price .COM (USD) | Price .NET (USD) | Registrations .COM (mln) | Registrations .NET (mln) |

|---|---|---|---|---|

| 2013 | 7.85 | 5.62 | 114.4 | 15.5 |

| 2014 | 7.85 | 6.18 | 119.0 | 15.5 |

| 2015 | 7.85 | 6.79 | 126.6 | 16.2 |

| 2016 | 7.85 | 7.46 | 131.3 | 16.1 |

| 2017 | 7.85 | 8.20 | 135.0 | 15.0 |

| 2018 | 7.85 | 9.02 | 142.0 | 14.3 |

| 2019 | 7.85 | 9.02 | 148.8 | 13.7 |

| 2020 | 7.85 | 9.02 | 155.3 | 13.7 |

| 2021 | 8.39 | 9.02 | 163.5 | 13.7 |

| 2022 | 8.97 | 9.02 | 213 | 19 |

| 2023 | 9.60 | 9.92 | 258 | 22 |

Analyzing the growth of these domains relative to their registration prices involves peering into a complex tapestry woven by factors such as the global expansion of internet access, the rise of mobile browsing, and the fluctuations of the online marketplace. As these domains are among the most sought after, their trajectory over the last decade can illuminate the broader direction of the domain registration industry and predict future movements.

Importance of Correlating Growth with Prices

The nexus between domain growth and registration prices is a mirror reflecting the state of the digital economy. It’s where the forces of supply and demand meet the realities of market saturation and innovation. By examining these aspects in tandem, stakeholders can make informed decisions, whether for launching a digital startup, investing in virtual real estate, or strategizing on brand expansion. For individual users, the cost of acquiring a domain is often a gateway to their online endeavors, while for businesses, it’s an investment that shapes their digital footprint.

The forthcoming analysis aims to chart the growth of .com and .net domains against the backdrop of their registration prices over a span of ten years. It’s a journey that traverses through an era of rapid digital transformation, where domains have served as both instruments and indicators of change. Let’s delve into the initial state of .com and .net registrations as of 2013 to set the stage for understanding how the ensuing decade unfolded.

The Initial State of .com and .net in 2013

As we turn back the pages to the year 2013, the landscape of the Internet was markedly different. The concept of digital real estate was still solidifying, with domain names increasingly recognized as vital assets for an online presence. Within this context, .com and .net domains stood out due to their established history and widespread recognition. To grasp the progression that would unfold over the subsequent decade, it’s pivotal to establish a historical benchmark of where .com and .net domains stood in terms of registrations and pricing at this juncture.

In 2013, the total number of domain name registrations across all Top-Level Domains (TLDs) reached approximately 271 million worldwide. Of this number, the .com and .net TLDs experienced aggregate growth, reaching a combined total of roughly 127.2 million domain names. More specifically, .com domain registrations dominated with about 112 million names, while .net accounted for 15.2 million, according to reports from VeriSign.

The pricing of domain names, an equally important aspect of the industry, typically sees influence from multiple factors including regulatory decisions, market demand, and cost of infrastructure. In 2013, the average price for registering a .com domain was stable, primarily due to the fixed pricing arrangements under VeriSign’s contract with the Internet Corporation for Assigned Names and Numbers (ICANN), which controlled the maximum price for .com domains. .Net domains, on the other hand, had a slightly higher registration cost due to less stringent price caps and lower overall market saturation.

The role of registrars – entities accredited by ICANN to sell domain names to the public – also influenced pricing. Competition among registrars often led to promotional pricing, discounts, and bundled services. This contributed to minor price variations and promotional incentives for end-users looking to secure a .com or .net domain.

Moreover, the domain aftermarket—where previously registered domain names are bought and sold—had begun to play a crucial role in the pricing dynamics. Premium domain names in the .com and .net extensions, which are considered valuable due to their short, memorable, and often keyword-rich nature, frequently commanded significant prices, far exceeding standard registration costs.

The sentiment towards .com and .net domains in 2013 was undeniably positive. Businesses viewed a .com address as an essential aspect of their online identity, and startups considered it a desirable launchpad for their digital presence. The .net extension, while less prevalent than .com, was still regarded as a credible alternative, often utilized when the desired .com was unavailable or by entities oriented towards network-related services.

2015-2016: Economic Factors and Market Corrections

As global economies experienced fluctuations with certain regions undergoing economic hardships while others saw a boon, domain registration growth rates mirrored these changes. In 2015, .com domains showed resilience with a growth rate of around 4.7%, while .net saw a slight slowdown. The pricing remained relatively stable, with only slight increases reflecting an equilibrium state between demand and availability. Despite these shifts, .com proved its status as the TLD of choice for businesses and individuals alike, maintaining a higher perceived value and price point than .net.

2017-2018: The Impact of Policy and Market Saturation

During 2017 and 2018, market saturation began to significantly impact domain registrations. The scarcity of desirable .com and .net names pushed their values up, particularly in the secondary market. As a direct result of VeriSign’s negotiated price caps with ICANN and subsequent policy changes, the end of 2018 saw the announcement of planned price hikes for both .com and .net domains. This period also saw the rise of new gTLDs (generic top-level domains) providing alternatives to traditional TLDs, although they had yet to make a significant dent in .com’s dominance or .net’s stability.

2019-2020: The Pandemic Effect and Digital Transformation

The advent of the COVID-19 pandemic in late 2019 and throughout 2020 brought about a tectonic shift in online activity. As businesses rapidly moved to online platforms due to lockdowns and social distancing, there was an unprecedented spike in domain registrations, especially for .com domains, which experienced a growth of up to 6% in certain quarters. The abrupt pivot to digital platforms forced a reevaluation of domain values, leading to a temporary stalling of registration price increases for .net domains, while .com domains saw a moderate increase due to the surge in demand.

2021: Post-pandemic Adjustments and Rising Prices

Post-pandemic recovery in 2021 prompted a readjustment of the digital landscape. Domain registration growth stabilized as the initial rush to acquire digital property waned. However, this year marked the beginning of a new pricing phase, with VeriSign implementing a 7% price increase for .com domains, the first substantial rise after nearly a decade of stability. This increase signaled a shift in strategy, balancing market demands with the need to maintain profitability against a backdrop of significant operational investments and inflationary pressures.

2022: Steadied Growth and Inflationary Influence

By 2022, the growth rates of domain registrations began to moderate. The aftereffects of inflation and further economic uncertainties had both direct and indirect impacts on the domain industry. Reflecting these economic factors, a second 7% price increase for .com domains took place as per VeriSign’s contractual agreement with ICANN. Meanwhile, .net domains also saw a 10% price increase, a more pronounced rise after years of stable pricing. These adjustments were emblematic of the pressure to maintain service quality while also securing profit margins amidst global financial shifts.

2023: Current Trajectory and Competitive Pressures

The data from the first two quarters of 2023 indicates a slight contraction in .com and .net domain registrations compared to the previous year. The market for domain registrations is highly competitive, and the continued release and growth of new gTLDs and ccTLDs (country-code top-level domains) provided alternatives that diversified the domain market landscape. Yet, .com domains still accounted for a substantial 161.3 million registrations, and .net held firm at 13.1 million registrations. Their prices, respectively, followed the trends set by the prior years’ increases, further solidifying their positions within the market despite the overall slower growth.

Conclusion domain registration on 2013 to 2023

In summary, from 2013 to 2023, the .com and .net domain markets have exhibited fluctuations in growth and pricing driven by a confluence of technological, economic, regulatory, and competitive factors. Key events, including policy shifts, market saturation, the introduction of new TLDs, and the pandemic, have shaped their trajectories in discernible ways. While .com domains consistently enjoyed robust growth and higher prices reflecting their premium status, .net domains demonstrated a more measured expansion with price increments aligned more closely with strategic price adjustments and market corrections.

Pandemic Influence and Domain Registrations

The emergence of the COVID-19 pandemic in 2020 became an unforeseen economic disruptor that impacted domain registrations and pricing. As businesses pivoted online to survive lockdowns and restrictions, the need for a strong online presence intensified. The domain registration industry boomed, with .com leading the charge as the preferred TLD for new and transitioning businesses.

This shift to digital reliance did not immediately translate to drastic price increases for .com domains. The modest annual increments adhered to the agreement with ICANN, which anticipated and accommodated for economic uncertainties. The underlying strategy was to ensure that .com remained an accessible and attractive option for businesses adapting to the new normal.

Connecting Price Changes to Economic Indicators

Linking back to broader economic trends, it is evident that domain pricing was not impervious to factors such as inflation and cost of living adjustments. The gradual price increases, particularly for .com domains, loosely mirrored these economic indicators. The intention was to preserve the business model while aligning with the financial reality of the time.

Inflation aside, strategic investments in domain infrastructure, such as the transition to more secure and robust DNS architectures, also contributed to the cost build-up. These enhancements, while essential for maintaining the health of the internet, were partially offset by the higher registration fees borne by registrants.

The Interplay of Supply and Demand

The interplay between supply and demand also played a key role in price dynamics. The finite nature of desirable .com domain names leads to a form of scarcity, particularly for short and memorable names. As these high-value domains become rarer, their value—and consequently, their registration and renewal prices—appreciably climb.

For .net domains, the supply-demand curve is more generous, allowing for more price flexibility. However, with fewer premium .net domains commanding high prices in the secondary market compared to their .com counterparts, the pricing power remains notably weaker.

Looking at the Numbers

As numbers serve as the backbone of any economic analysis, delving into the statistics provides a clearer picture. According to a VeriSign report, .com domains experienced only a minimal reduction in registrations in the second quarter of 2023 compared to the first quarter. However, the slight dip did little to affect the upward year-on-year growth trend, demonstrating the TLD’s ability to maintain momentum even against a backdrop of rising prices.

For .net, the journey has been less linear. Fluctuations in registrations were more pronounced over the decade, reflecting a more sensitive relationship between pricing and demand. Nonetheless, .net domains have persisted as a staple within their market niche, albeit with a smaller footprint compared to the behemoth that is .com.

Current State and Future Outlook

When we dissect the growth dynamics of .com and .net in light of registration prices, it’s clear that the value associated with .com has enabled it to navigate price increments with minimal impact on growth. However, .net seems to sit at a more delicate balance, with its growth somewhat tempered by the fluctuations in registration pricing and increased competition from alternative TLDs.

These trends are not just historical footnotes but carry practical implications for businesses and domain investors. For businesses, investing in a .com domain remains a sound strategy, aligning with consumer expectations and the entrenched status of .com in the market. While higher prices may require thoughtful consideration of budgets, the long-term equity in a .com domain could outweigh immediate cost concerns.

Domain investors, on the other hand, should consider the resilience of .com growth against price hikes and the nuanced market responses to .net pricing strategies. The premium attached to .com domains suggests a robust secondary market and continued investor interest. .net domains, while potentially less lucrative, offer stability that can be attractive in a diversified investment portfolio.

As we look to the future, it’s clear that .com and .net will continue to play integral roles in the domain market’s fabric. They will serve as benchmarks for the performance of TLDs in an ecosystem that becomes more complex and crowded with each passing year. Yet, it will be the enduring qualities—reliability, recognition, and resilience—that will define their continued growth in the face of fluctuating registration prices and shifting market landscapes.

In summarizing, the past decade has highlighted the nuanced relationship between the growth of domain registrations and their pricing. While the .com domain has demonstrated a robust growth dynamic relatively impervious to price changes, .net has shown more sensitivity to these factors. These insights pave the way for informed decisions by stakeholders looking to navigate the evolving domain name market, where the intersection of value, growth, and price remains a central theme.