In the latest financial report released by GoDaddy Inc., the renowned web services company has showcased a stellar performance, underscoring its resilience and growth potential in the hosting market. The report comes against the backdrop of heightened investor interest and strategic scrutiny, as highlighted in a recent letter addressed to the company’s board of directors by prominent shareholder Starboard Value LP. Let’s delve into the details of GoDaddy’s financial results, contextualizing them within the broader narrative of shareholder expectations and corporate strategy.

According to the report, GoDaddy’s revenue for the fiscal quarter exceeded expectations, reaching a robust $1.5 billion, marking a significant increase from the previous quarter’s $1.3 billion. This represents a notable growth trajectory for the company, showcasing its ability to capitalize on emerging opportunities in the digital marketplace. Notably, the revenue growth was driven by strong performance across key segments, including domain registration, hosting, and online presence solutions. Such results affirm GoDaddy’s position as a market leader in providing essential web services to businesses and individuals worldwide.

Hosting and Presence segment revenue experienced a robust 17% year-over-year growth, amounting to $680 million, fueled by increased adoption of hosting solutions and website building tools. Online Stores revenue soared by 25% year-over-year, totaling $335 million, reflecting the growing demand for e-commerce solutions among businesses and entrepreneurs.

Product Performance Insights:

- The earnings presentation highlights GoDaddy’s continued investment in product innovation and enhancement, with a focus on driving customer engagement and satisfaction.

- Notable product achievements include the launch of GoDaddy Commerce, a comprehensive e-commerce platform designed to empower small businesses in establishing and growing their online stores.

- GoDaddy’s website building tools, such as Websites + Marketing, have seen significant traction, with over 1.5 million websites created on the platform during the quarter.

- The company’s Managed WordPress offering continues to attract users seeking reliable and scalable solutions for their WordPress-powered websites, contributing to the overall growth of the Hosting and Presence segment.

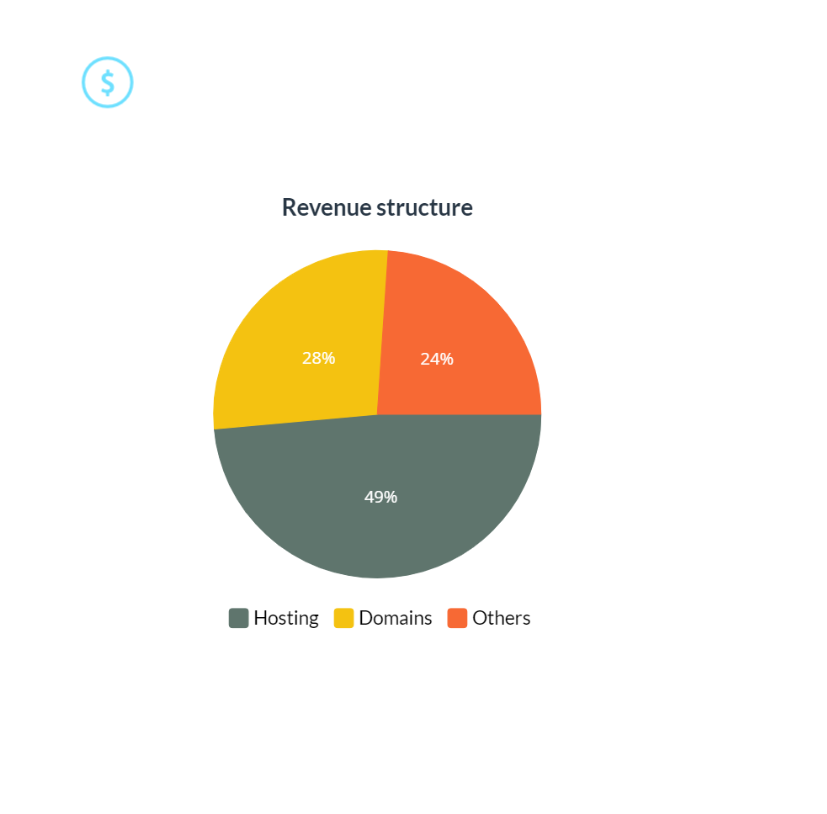

The latest financial results from GoDaddy reaffirm that hosting remains the largest revenue contributor for the company. Hosting services accounted for $680 million in revenue, constituting 45% of the total revenue. Meanwhile, domain-related revenue amounted to $385 million, representing 26% of the total, showcasing the enduring importance of domain services. Additionally, revenue from other products totaled $335 million, contributing only 29% to the overall revenue. This breakdown underscores the diversified revenue streams of GoDaddy, with hosting standing out as the primary driver of its financial performance.

In Q4 2022, GoDaddy achieved an ARPU of $197, reflecting the average revenue generated per user across its various product segments. Fast forward to Q4 2023, and we see a notable increase in ARPU to $203. This upward trend indicates GoDaddy’s success in enhancing its monetization efforts and extracting more value from its customer base over time.

The increase in ARPU from Q4 2022 to Q4 2023 suggests several positive developments within GoDaddy’s business model. It could be attributed to the successful implementation of pricing strategies, upselling of premium products and services, or improved customer retention efforts. Additionally, advancements in technology and product offerings may have contributed to higher ARPU by providing customers with more opportunities to engage with and spend on GoDaddy’s platform.

Despite these positive financial indicators, the letter from Starboard Value LP raises pertinent questions regarding capital allocation, operational efficiency, and shareholder value creation. Specifically, Starboard emphasizes the importance of optimizing GoDaddy’s portfolio and cost structure to unlock shareholder value and ensure sustainable long-term growth.

In response to these concerns, GoDaddy reaffirms its commitment to shareholder value creation and transparent governance practices. The company acknowledges the need for effective capital allocation and operational efficiency to maximize returns for shareholders. Moreover, GoDaddy emphasizes its dedication to ongoing dialogue and collaboration with shareholders to address their concerns and align corporate strategies with investor expectations.

While GoDaddy’s financial results speak volumes about its growth trajectory and market positioning, the shareholder letter serves as a reminder of the importance of effective communication and alignment with investor interests. By addressing shareholder concerns and leveraging its strengths in innovation and market leadership, GoDaddy aims to navigate the evolving landscape of the digital economy while delivering sustainable value to shareholders.

Looking ahead, GoDaddy remains committed to driving growth and profitability through product innovation, customer-centricity, and operational excellence. As the company continues to execute its strategic roadmap, effective engagement with shareholders will remain paramount in building trust, fostering transparency, and driving long-term shareholder value.

Interestingly, amidst GoDaddy’s robust financial performance, Tucows, a notable player in the domain services industry, experienced a decline in its stock value yesterday. While GoDaddy reported impressive revenue figures, Tucows faced a stark contrast as its stock (TCX) dropped by 10%. This discrepancy underscores the dynamic nature of the market and the divergent fortunes of companies within the same sector.