IONOS Group SE, headquartered in Germany, boasts a rich history dating back to its establishment in 1988. Initially known as 1&1, the company quickly expanded its operations to become one of the leading providers of web hosting and cloud services worldwide. With a strong presence in Europe and North America, IONOS serves a diverse clientele, ranging from small businesses to large enterprises, offering a comprehensive suite of services to meet their digital needs.

Over the years, it has been widely believed that IONOS poses a strong and significant competition to GoDaddy. However, upon analyzing the financial results, a notable disparity in financial performance between the two companies becomes apparent.

Additionally, the fragmented structure of entities and independent brands in various countries (e.g., UK, Poland) is quite noticeable. IONOS, deriving from Europe, faced limitations in scalability compared to American companies driven by the force of globalization. Its current strength and position (TOP 1 in several European countries) were achieved through a combination of organic growth and acquisitions.

The history of 1&1’s entry into Poland serves as a classic example of the challenges associated with entering local markets with their own specific conditions and dynamics. Despite substantial investments and a highly aggressive marketing campaign, including television advertising and free services for 2 years, the brand withdrew from Poland. Simultaneously, it acquired the largest hosting company in Poland – home.pl, paying – ATTENTION – a multiplier of x15-16 EBITDA. This position seems to remain unchallenged to this day.

Let’s delve into the business performance of Ionos in 2023 and analyze its significant achievements and market dynamics.

Financial Overview

Table 1: IONOS Financial Performance in 2023

| Metric | Value |

|---|---|

| Total Revenue | €1.42 billion (10% YoY growth) |

| Adjusted EBITDA | €390 million (27.4% margin) |

| Number of Customers | ~6.19 million |

| Average Revenue Per User (ARPU) | €14.70 (+5.0% YoY) |

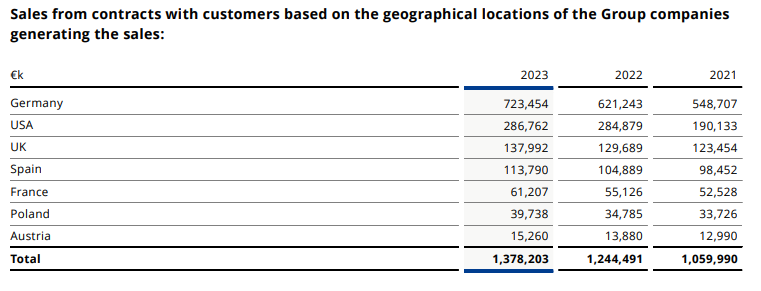

In 2023, IONOS achieved €1.42 billion in total revenue, representing a solid 10% year-over-year growth. The company’s adjusted EBITDA of €390 million, with a margin of 27.4%, indicates attractive profitability. IONOS serves approximately 6.19 million customers, leveraging its unparalleled access to European SMBs.

Market Expansion

IONOS continued its expansion into key markets, capitalizing on growing demand for web hosting services globally. The company strengthened its presence in both established and emerging markets, consolidating its position as a leading provider of cloud infrastructure and hosting solutions.

Table 2: IONOS Market Performance in 2023

| Region | Revenue Growth (%) |

| DACH (Germany, Austria, Switzerland) | +8.3% |

| Europe (excl. DACH) | +10.1% |

| Americas | +12.7% |

| APAC | +9.5% |

IONOS experienced significant revenue growth across all major regions in 2023. The DACH region witnessed a growth rate of 8.3%, driven by strong customer demand and strategic initiatives. Moreover, Ionos expanded its footprint in Europe (excluding DACH), Americas, and APAC, achieving revenue growth rates of 10.1%, 12.7%, and 9.5%, respectively.

Product’s Performance

Ionos offers a comprehensive suite of services catering to the diverse needs of businesses, including web hosting, cloud infrastructure, domain registration, and website building tools.

Unfortunately, the reports do not provide details on the performance of specific product groups (hosting, domains, others).

As with other large companies, it is likely that hosting is still the company’s main source of revenue. It is very interesting to see how little attention this product gets in the market compared to many other services – mainly SaaS. Hosting has started to become more of a one-size-fits-all for the big players in the hosting market for many years, and it’s hard for the average customer to tell the difference between one service and another when they run on very similar (or the same) software.

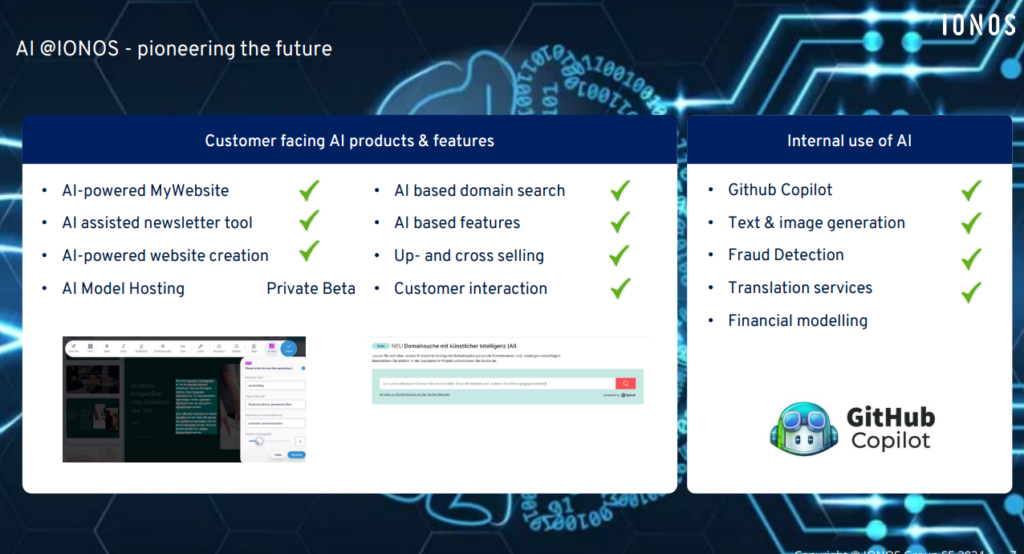

IONOS, like almost all companies in the market, recognizes the changes associated with AI, which is why it (like other companies) is implementing an AI-enhanced website builder.

Whether a whole bunch of such products will actually increase market penetration and encourage entrepreneurs to simply build their websites in my opinion is uncertain, but the coming years will clearly show the results.

Conclusion

IONOS, like most hosting companies, is seeing steady, modest growth in its customer base. Reading the report presented below, we can guess that we should not expect a revolution in the coming years. Just another stable, reasonably run business. It may not be sexy, but it’s certainly predictable and secure which investors appreciate. This is reflected in the company’s stock market valuation reaching almost $3 billion (vs. GoDaddy’s $16 billion valuation)

As a curiosity, we will present a comparison of IONOS results with GoDaddy. The conclusions are quite clear.

Table 1: IONOS vs. GoDaddy – Financial Performance in 2023

| Metric | Ionos (EUR) | GoDaddy (USD) |

| Revenue | €2,185 million | $4,480 million |

| Adjusted EBITDA | €502 million | $1,080 million |

| Free Cash Flow | €357 million | $830 million |

Sources: