In the second quarter of 2024, Tucows Inc. reported a notable performance across its business segments. The company demonstrated resilience and growth despite facing some financial challenges, with key metrics reflecting both improvements and areas of concern. Here’s an in-depth look at Tucows’ financial performance for Q2 2024.

Revenue growth across segments

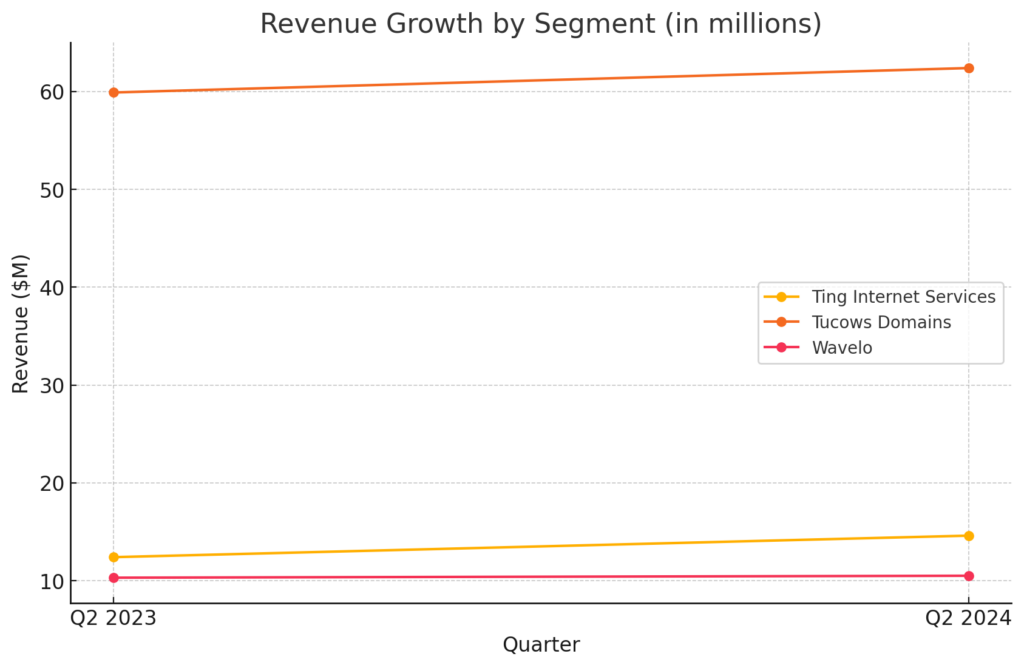

Tucows’ consolidated net revenue for Q2 2024 was $89.4 million, representing a 5.2% increase compared to $85.0 million in the same quarter of 2023. This growth was driven primarily by the company’s domain services and Ting Internet services, both of which showed year-over-year revenue increases.

- Ting Internet Services: Revenue from Ting Internet services increased by 17.4% year-over-year, reaching $14.6 million in Q2 2024, up from $12.4 million in Q2 2023. The growth is attributed to a steady increase in subscribers, with 48.2 thousand internet subscribers under management, a rise from 38.6 thousand in the same quarter last year.

- Tucows Domains: Tucows’ domain services segment, which remains the company’s largest revenue generator, reported a 4.0% year-over-year increase in revenue, totaling $62.4 million. The wholesale domain services saw growth from $51.5 million to $53.0 million, while the retail segment also increased from $8.4 million to $9.4 million.

- Wavelo: The Wavelo segment remained relatively stable with a slight increase in revenue, contributing $10.5 million, compared to $10.3 million in Q2 2023.

Gross profit and margin expansion

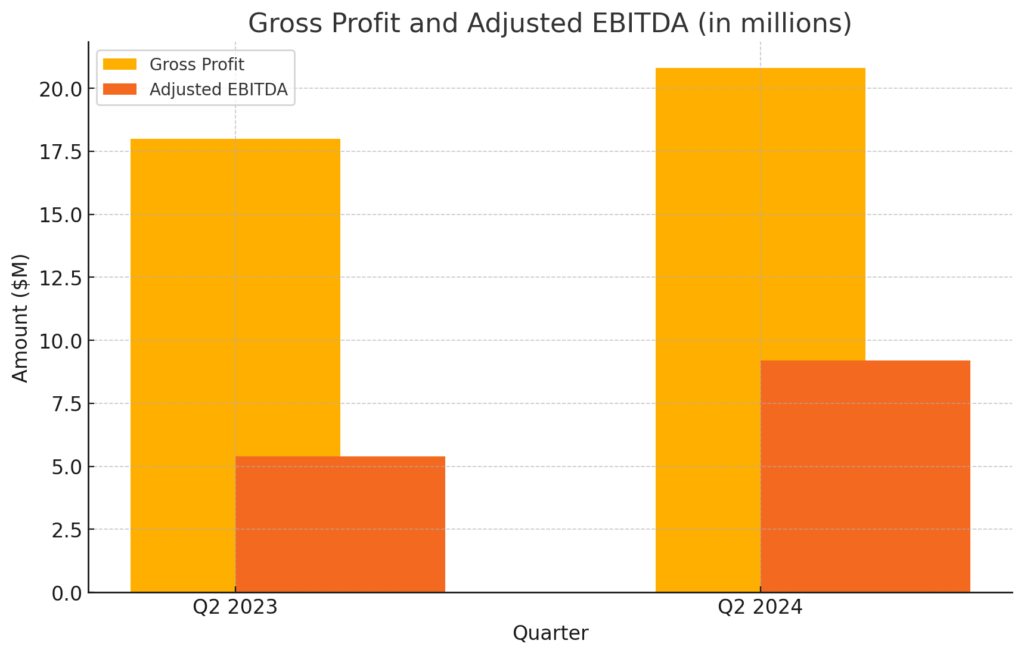

Tucows’ gross profit for Q2 2024 was $20.8 million, a 15.4% increase from $18.0 million in Q2 2023. The gross margin also improved significantly, driven largely by the Ting segment, which saw its gross margin increase by 39.2%, from $7.1 million to $9.8 million. This improvement is particularly noteworthy given the ongoing investments in expanding Ting’s fiber network, which has also led to increased depreciation costs.

Adjusted EBITDA and net loss

One of the standout metrics for Q2 2024 was the company’s adjusted EBITDA, which saw a 70% increase, reaching $9.2 million, compared to $5.4 million in the same period last year. This substantial improvement was fueled by both revenue growth and disciplined cost management across all segments.

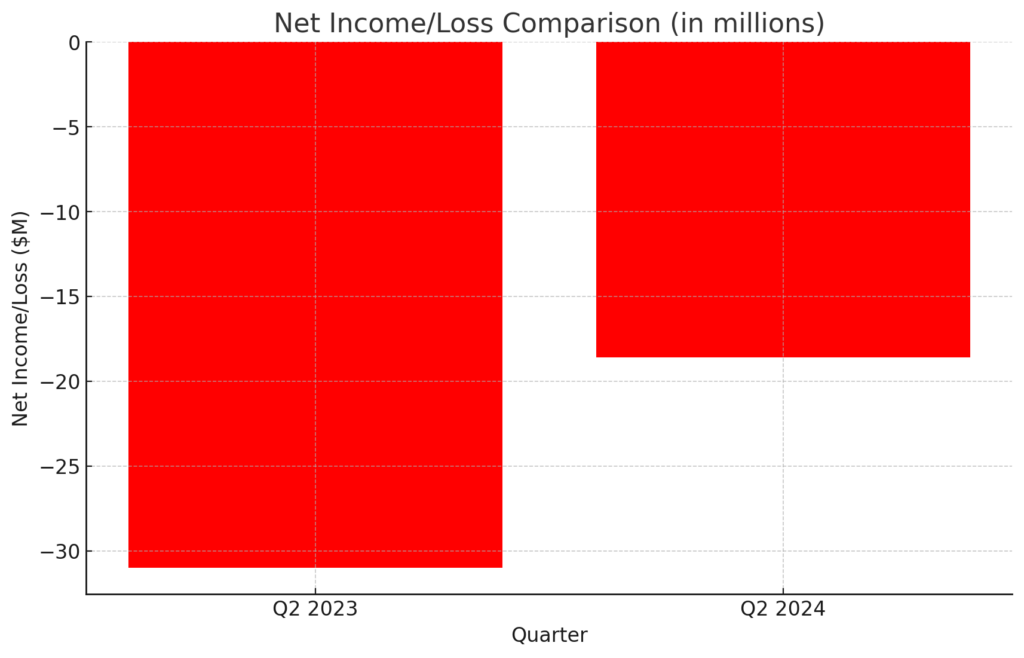

However, despite these positive metrics, Tucows reported a net loss of $18.6 million for Q2 2024, an improvement from the $31.0 million loss reported in Q2 2023. The reduction in net loss was primarily due to the absence of a one-time debt extinguishment cost that significantly impacted the previous year’s results.

Cash flow and financial position

Tucows’ cash position showed a notable decline, with cash, cash equivalents, and restricted cash totaling $52.2 million at the end of Q2 2024, down from $159.6 million at the end of Q2 2023. This reduction was influenced by continued investments in the Ting network and the repayment of debt.

To summarize, Tucows has shown strong revenue growth, particularly in its Ting Internet and Domains segments, while also improving its gross profit and adjusted EBITDA. However, the company continues to navigate financial challenges, including a significant net loss and a reduction in its cash reserves.

In conclusion, while Tucows continues to face certain financial challenges, the company’s efforts to grow its key business segments are evident in the improved revenue, gross profit, and adjusted EBITDA figures. As the company continues to invest in its infrastructure and manage costs, it is poised to further solidify its position in the market.

Kamil Kołosowski

Author of this post.