VeriSign, a leading company in domain name registry services, recently released its financial results for the third quarter of 2024. These results show a mixture of positive growth and challenges, making them significant for investors looking to understand the company’s trajectory.

Revenue performance

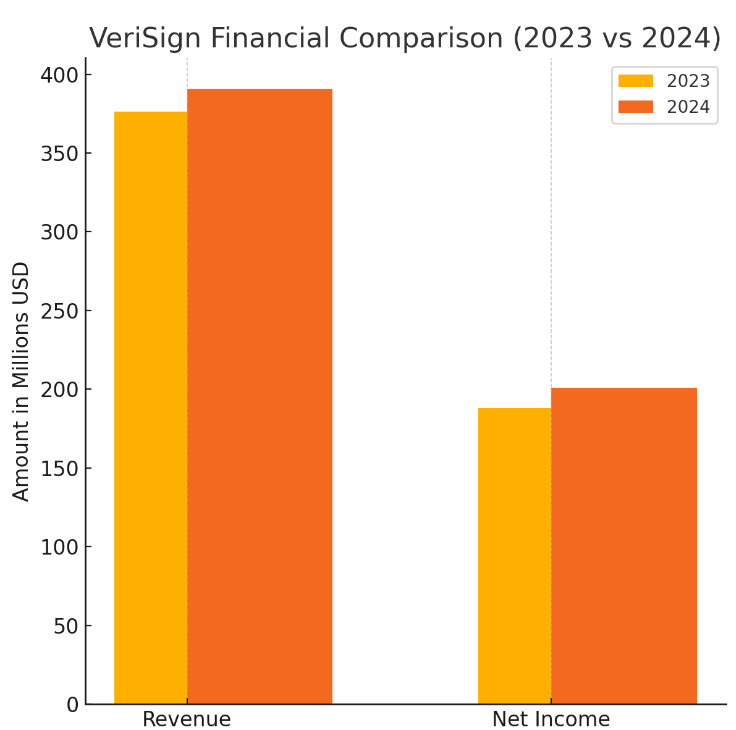

VeriSign reported total revenues of $391 million for the third quarter of 2024. This marks a 3.8% increase from the $376.3 million reported in the same quarter last year. The growth in revenue can be attributed to the increasing demand for domain names as more businesses look to strengthen their online presence. As companies adapt to digital markets, they are opting for memorable domain names to attract customers, which directly benefits VeriSign.

The company’s net income also saw an upward trend, reaching $201 million for the third quarter of 2024, compared to $188 million in the previous year. This increase translates to a rise in diluted earnings per share (EPS), which improved to $2.07 from $1.83 year-over-year. This growth in profitability indicates that VeriSign is not only increasing its revenues but also managing its costs effectively, providing a positive signal for investors.

Domain name registrations

Despite the overall growth in revenue and profit, VeriSign faced a decline in domain registrations. As of September 30, 2024, the total number of .com and .net domain registrations stood at 169.6 million, reflecting a 2.5% decrease from the previous year. The company processed 9.3 million new domain registrations during this quarter, down from 9.9 million in Q3 2023. This decline raises some concerns, as it may suggest a slowdown in the market for new domain registrations, which is a critical aspect of VeriSign’s business.

Cash flow and liquidity

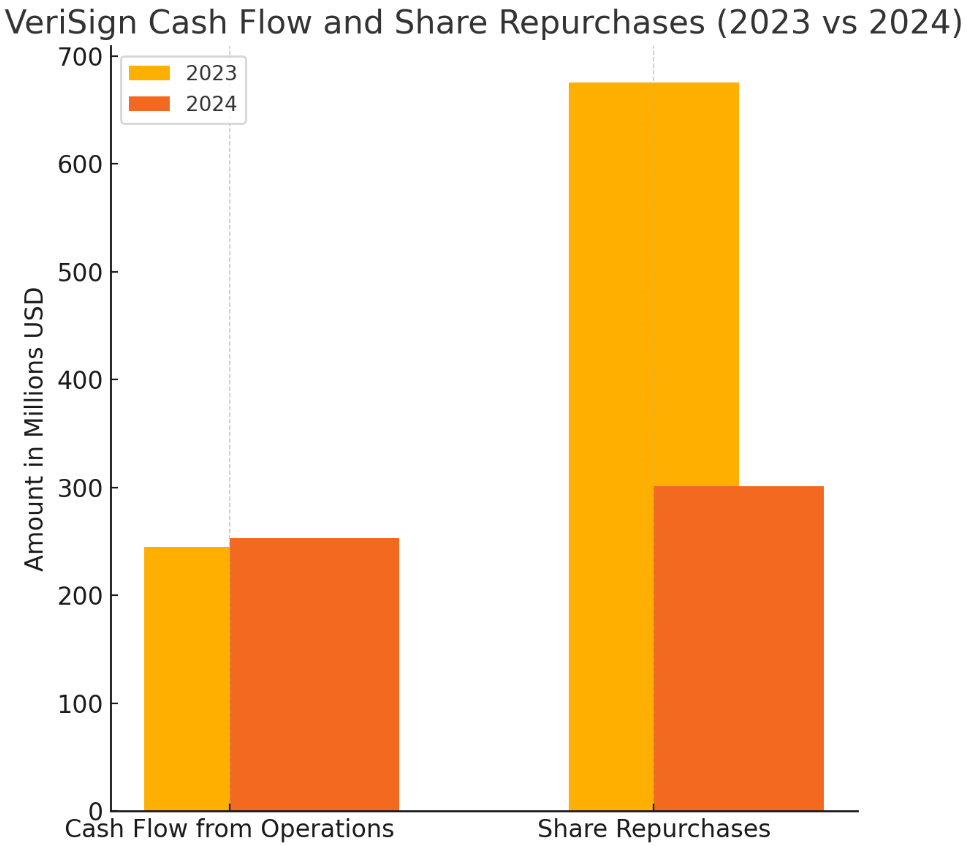

VeriSign ended the quarter with $645 million in cash, cash equivalents, and marketable securities, down $281 million from the end of 2023. However, the company reported cash flow from operations of $253 million, a slight increase from $245 million in the same quarter of the previous year. This positive cash flow is essential for maintaining liquidity and supporting ongoing business operations and investments.

During the third quarter, VeriSign repurchased 1.7 million shares of its common stock at a total cost of $301 million. As of September 30, 2024, there remains $1.28 billion available for future share repurchases. This move reflects the company’s commitment to returning value to its shareholders, indicating confidence in its future performance.

Renewal rates analysis

The renewal rate for .com and .net domains was 72.7% for the second quarter of 2024, down from 73.4% in the same period last year. The renewal rate is a crucial metric as it indicates customer retention and ongoing demand for VeriSign’s services. A decline in this rate may suggest challenges in maintaining customer loyalty, which is vital for sustained revenue growth.

VeriSign’s financial results for Q3 2024 present a mixed outlook. While the company has achieved revenue growth and increased profitability, the decline in domain registrations and renewal rates raises some concerns. Investors should keep a close eye on these trends as they could impact future performance.

The company’s ongoing commitment to maintaining a strong balance sheet, generating positive cash flow, and repurchasing shares demonstrates a proactive approach to shareholder value. However, the potential slowdown in the domain registration market may require strategic adjustments moving forward.

As investors evaluate VeriSign’s performance, the key will be monitoring the company’s ability to adapt to market changes while continuing to capitalize on the growing demand for digital services.

Kamil Kołosowski

Author of this post.