TL;DR – Many companies focus their growth narratives around cloud, platforms, or AI layers on top. Against that, IONOS stands out, mainly because it never tried to reinvent shared hosting.

Instead, IONOS quietly turned shared hosting and domains into a highly efficient cross-sell engine and continues to expand ARPU while keeping churn flat. The company’s public filings over the last five years show a model that is operationally disciplined and unusually effective.

What and how IONOS is selling

IONOS reports hosting, domains, email, and related SMB tools together under its Web Presence & Productivity business unit (now part of the broader Digital Solutions & Cloud segment after reporting changes in late 2024). The company does not publish product-level revenue splits for shared hosting or domains, and that is intentional.

From an investor perspective, IONOS does not sell “shared hosting”, only recurring web presence.

Domains are the entry product, hosting is the operational dependency and everything else attaches naturally over time.

That framing matters, because it explains why:

- ~80% of revenue is recurring,

- ARPU has grown steadily for years,

- and monthly churn has remained around ~1%, even after pricing changes.

Which numbers actually matter

Across filings from 2021 through 2025, several patterns repeat consistently:

- Web Presence & Productivity remains the core revenue driver, accounting for roughly 75-80% of group revenue, depending on year and reporting structure,

- customer growth is modest but steady, reaching over 6.3 million customers by the end of 2024,

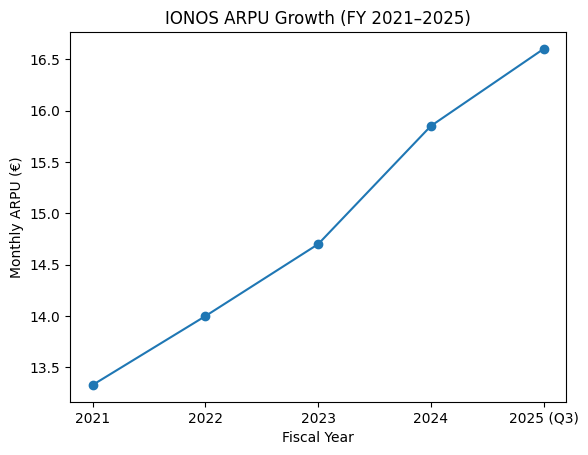

- ARPU keeps rising, moving from the low-€13 range earlier in the decade to the €16,6 2025,

- churn stays flat, even as prices increase.

Combination of rising ARPU with stable churn is rare in mass-market hosting and signals that revenue growth is coming from value expansion, not pressure selling.

IONOS explicitly attributes this to:

- pricing optimization,

- successful up- and cross-selling,

- and a growing number of services per customer.

Not new customer volume and not promotional BS.

How cross-sell works without feeling like upsell

What’s notable in IONOS’s disclosures is not what they say, but what they don’t say.

There is no heavy emphasis on funnels, conversion hacks, or aggressive bundling tactics. Instead, management repeatedly talks about:

- attach rates,

- portfolio integration,

- and customer lifetime value.

The logic behind this seems quite simple:

- Domains bring customers in.

- Hosting makes the relationship “sticky”.

- Email, SSL, backups, e-commerce tools, and higher tiers follow as operational needs emerge, as natural, not forced consequence.

Cross-sell is done through completing the stack necessary for an SMB that wants its website to “just work well”.

Domains role as the retention engine

Domains are consistently described in IONOS materials as the starting point of the customer relationship. While the company does not disclose standalone domain margins or renewal rates, the implications are clear:

- domains have extremely low churn,

- renewals reinforce long customer lifetimes,

- they anchor customers inside the IONOS ecosystem.

Once a domain is registered, the switching cost becomes a barrier for many. Hosting, email, and site tooling naturally follow, not because of bundling tricks, but because fragmentation creates friction for SMBs.

This is why IONOS treats domains not as a lead generator, but as a long-term retention asset.

What IONOS watches and what it ignores

IONOS does not frame shared hosting as a temporary stop on the way to the cloud, but treats it as a durable product class that evolves slowly and monetizes reliably.

We have read multiple IONOS investor presentations and noticed an important pattern of where management attention actually goes – to KPIs that really matter:

- ARPU,

- churn,

- CLTV/CAC,

- attach rate of services per customer,

- operational efficiency.

What is missing? Marketing BS, aggressive migration narratives or promises that shared hosting will be “reinvented” and the market will be “disrupted”.

What IONOS stopped doing is just as important

One of the clearest strategic signals in recent years was IONOS’s decision to de-prioritize and later stop domain parking and aftermarket domain trading activities. Management explicitly framed this as a focus issue: the business was volatile, distracting, and not core.

That move sharpened the company’s identity by cutting earnings “noise” and tighter alignment around hosting, domains, and SMB subscriptions.

In other words, IONOS improved its cross-sell engine not by adding more products, but by removing entire businesses that didn’t reinforce the core.

Why this model works

Many hosting providers try to increase ARPU by adding features, dashboards, or one-off upsells. IONOS does the opposite:

- it hides complexity through integration,

- it bundles responsibly instead of packing BS features,

- it puts a price on stability, not optionality.

As a result, customers don’t feel sold to only feel relieved, and that might be the main reason cross-sell works here.

The takeaway for hosting operators

At the end of the day ARPU growth without growing churn is the only metric that really matters.

IONOS’s successful strategy is proof that shared hosting works well when you treat it as a base for a long relationship with customers. The company isn’t winning by reinventing hosting, only by executing the basics better than almost anyone else.

Damian Andruszkiewicz

Author of this post.