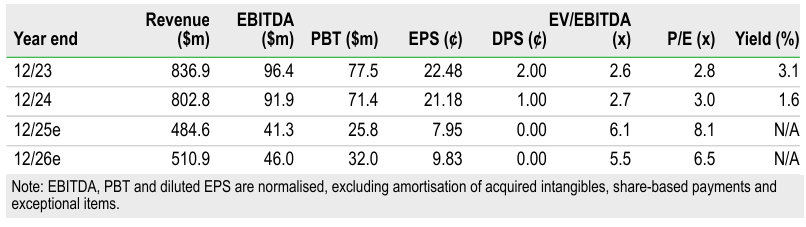

TL;DR – shares of Team Internet Group are down more than 50% year-on-year after a difficult 2025, mostly caused by a sharp reset in the domain monetization market. The company is now openly talking about the sale of their domains business. The move follows changes driven by Google’s advertising policy shifts, which undermined the economics of large-scale domain parking.

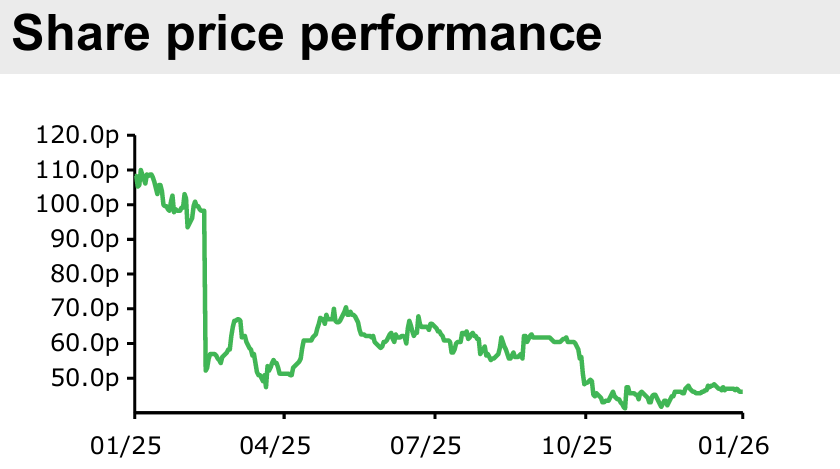

Shares down sharply year-on-year

Over the past 12 months, Team Internet Group’s share price has fallen by more than 50%. The drop follows a difficult year for the company and reflects growing uncertainty around parts of its business.

Management has pointed to “improved momentum in the final quarter and tighter cost control across the group”. Even so, the share price performance suggests investors are still waiting for clearer signals about where the company is heading next.

What sits inside Team Internet Group

Today, Team Internet operates across several areas, including domain infrastructure, comparison platforms, and traffic monetization.

- Domains, Identity and Software (DIS)

This segment covers the group’s domain infrastructure and identity-related services. It includes wholesale and reseller platforms such as CentralNic Reseller, HEXONET, TPP Wholesale, PartnerGate, and NameAction. The group also runs registry and backend services through CentralNic Registry and manages country-code and regional TLDs, including .sk, .RUHR, and .Saarland.

DIS also includes corporate domain management and brand protection services, operated through businesses like Safebrands and IPMC, as well as software products such as the Voluum analytics platform. - Comparison and affiliate platforms

Alongside domains, Team Internet has built a portfolio of comparison and content-driven affiliate sites. These include brands such as Vergleich.org in Germany and Meilleurs.fr in France, as well as a wider network operated through VGL Publishing. Management has highlighted this segment as an area that showed improving momentum toward the end of 2025. - Search and traffic monetization

The search segment focuses on monetizing user intent and direct navigation traffic. It includes platforms such as ParkingCrew, TONIC, Zeropark, and related technologies used to acquire and route traffic. This is the part of the business most affected by 2025 monetization changes.

How Google policy changes affected TIG

Over the past two years, Google’s decision to phase out AdSense for Domains and push the industry toward other monetization models has significantly reduced revenue from traditional domain parking.

When the 2024 year results of Team Internet Group were published, one of the leading narratives among analytics was that transition from Google AdSense for Domains to Related Search on Content will dominate the picture in 2025.

As we see today clearly, that shift led to falling revenue of TIG and higher operational costs. Team Internet has previously linked layoffs of more than 200 employees in late summer 2025 and broader cost reductions directly to these changes in advertising policy.

Rethinking the domains business place

The company confirmed that talks related to a potential sale of Domains, Identity and Software (DIS) are ongoing and described progress as positive.

Why this part of the business? Google changes damaged mostly Search, which forced a wider strategic rethink. In the process, DIS emerged as the cleanest asset – easiest to sell and with defensible valuation. That is why DIS is considered for sale – not because it’s broken, but because it’s sellable.

An important part of DIS value is a 10-year contract to manage and operate .co domain, signed in 2025 with the Ministry of Information and Communications Technology of Colombia.

According to the board, any transaction could be valued above the group’s current market capitalization of £118m.

What comes next

For now, Team Internet is trying to do two things at once: stabilize performance after a difficult year and decide which parts of the business to keep.

While the Search segment has absorbed the biggest shock, it is the DIS business that offers the clearest path to a transaction. With stable revenues, long-term contracts, and a structure that can operate independently, DIS is the part of the group that can be sold with the least disruption. Whether Team Internet ultimately goes down that route will determine how the company reshapes itself after a year that fundamentally changed the economics of domain monetization.

With discussions around the DIS segment continuing, the outcome of the sales talks is likely to play a central role in how the company will be reshaped in 2026.

Damian Andruszkiewicz

Author of this post.