TL;DR – On January 26, 2026 S&P Global, one of the three largest rating agencies in the world, published its latest report on Newfold Digital: “Upgraded To ‘CCC+’ Following Debt Restructuring”

One sentence inside the analysis changes the positive impression an ‘upgrade’ usually creates: Newfold has lost more than 1 million subscribers since 2023 according to analytics.

S&P Global Ratings in numbers and why their findings matter

If you publish a claim as serious as “company lost 1 million users”, even if it’s only a quote, you must know whether the source is trustworthy. Newfold is a multi-brand hosting conglomerate, with large brands such as Bluehost, HostGator, Network Solutions or Domain.com.

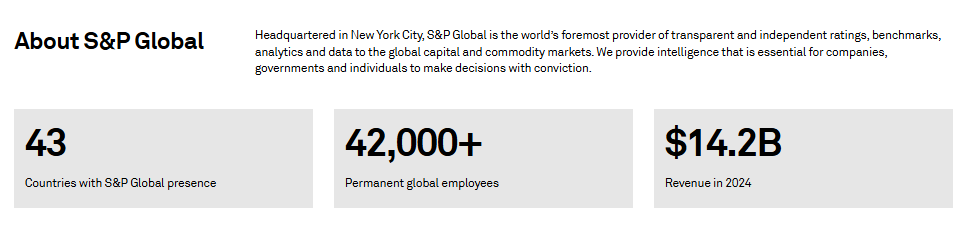

Why does data and insights from this rating agency matter? S&P Global Ratings is part of S&P Global, a financial analytics company with more than $14 billion in annual revenue and 42,000 employees (S&P Global 2024 Impact Report).

It is one of the Big Three rating agencies, alongside Moody’s and Fitch, and its credit opinions are used by 95% of the world’s top institutional investors.

It’s not a random financial blogger, but a regulated, data-driven institution with access to non-public issuer data.

Why S&P says “we believe” and not “we know”

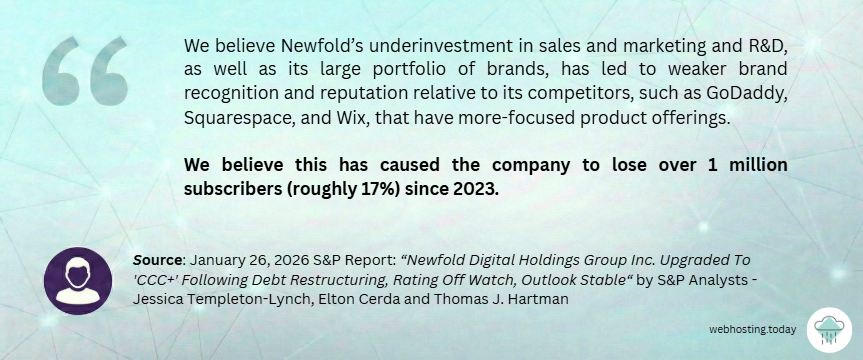

Credit agencies must phrase their public reports as analyst judgments. They receive confidential operating metrics from Newfold, including subscriber levels and churn, but cannot publish raw internal numbers directly.

So when S&P writes “We believe the company has lost over 1 million subscribers (roughly 17%) since 2023” it is an analyst conclusion based on Newfold’s non-public data, S&P’s internal models and cross-checks against public information.

Where the number comes from

S&P now says Newfold has 5.8 million subscribers (January 2026).

Newfold previously claimed around 6.8-7.0 million subscribers (public statements in prior years).

S&P ties this decline to several factors:

- lower investment in sales and marketing,

- slower R&D compared to competitors,

- a diluted multi-brand structure,

- weaker brand recognition vs GoDaddy, Wix, Squarespace,

- declining organic revenue while peers grew 7–30% a year.

All of this is pulled directly from the S&P report.

How Fitch’s analysis supports the S&P number

We reviewed multiple available public sources and found no other reference of that “lost” 1 million anywhere else than the S&P website. But we found a Fitch’s January 15, 2026 report (“Fitch Downgrades Newfold to ‘RD’ on DDE; Upgrades to ‘B-‘; Assigns Stable Outlook”) that provides additional context:

- “about 6.5 million average subscribers”,

- high churn among SMB customers,

- negative revenue growth,

- heavy competition.

That 6.5M figure Fitch used is an average across 2024-2025, not a point-in-time snapshot. And it sits credibly between the 2023 baseline and the S&P 2026 number:

- 2023: 6.8-7.0M,

- 2024-2025 average: ~6.5M (Fitch),

- 2026: 5.8M (S&P).

The math is consistent and the trend of subscriber loss seems to be visible.

Bottom line

In December 2025 we reported that Newfold had secured $100 million from its existing owners and described it as recapitalization, not growth funding.

The January reports from S&P and Fitch now provide the missing context – Newfold haslost around 17% of its subscribers since 2023, and both agencies describe ongoing revenue pressure and high churn.

This gives a clearer picture of why strengthening the balance sheet was necessary and why the financing was not framed as growth capital.

Damian Andruszkiewicz

Author of this post.