Tucows just put up a better year on paper – $390.3m revenue and $50.6m Adjusted EBITDA in FY2025 – while still posting a $75.8m net loss. The gap is mostly financing weight and depreciation from Ting-era infrastructure: $55.3m net interest expense in FY2025 alone. Management’s answer is blunt: sell Ting, then run a simpler, more capital‑light Tucows built around Domains and Wavelo.

The problem is that Ting is not a clean asset to hand over. It sits under layered financing with long-dated ABS notes and a high-cost preferred stack – plus a recent warning flare: Ting missed preferred return payments, and the preferred holder’s estimated redemption price is ~$186m if a redemption is demanded.

So “post‑Ting” is not just a strategy slide. It is a sequencing question: get out (or de-risk) Ting without collateral damage, then decide whether the freed cash goes first to debt, buybacks, or acquisitions – because Tucows already authorized a new $40m buyback.

The numbers that matter

Start with what is real and measurable. In FY2025 Tucows reported $390.3m net revenue (+8% YoY), $94.0m gross profit (+13% YoY), and $50.6m Adjusted EBITDA (+45% YoY). Cash flow was still a grind: ($5.8m) operating cash flow for the year. Year-end liquidity (including restricted items) was $64.2m.

By segment in FY2025:

- Domains generated $267.1m revenue and $48.7m Adjusted EBITDA.

- Wavelo generated $47.6m revenue and $17.5m Adjusted EBITDA.

- Ting generated $68.2m revenue but still an Adjusted EBITDA loss of ($6.2m) (improved vs ($22.5m) in 2024).

The balance sheet explains the persistent GAAP loss. At Dec. 31, 2025 Tucows reported $55.3m net interest expense (FY2025), plus heavy depreciation, and still carried substantial debt and Ting-linked obligations.

There are also “quiet” recurring cash contributors that investors sometimes ignore. The “income earned on sale of transferred assets” line was $11.6m in FY2025 this is tied to the long payment stream from the prior mobile asset sale.

Now the forward guide that matters most: management gave FY2026 Adjusted EBITDA guidance excluding Ting of $52.5m–$58.5m (Domains $47m–$49m, Wavelo $14.5m–$15.5m, Corporate ($6m)–($9m)).

Ting sale is not a simple divestiture

The “sell Ting” line reads clean. The Ting capital stack does not. Ting’s funding includes asset-backed securitizations and preferred equity that is expensive, rule-heavy, and time‑sensitive:

- Ting’s 2023 securitization issued three classes totaling $238.5m with stated coupons 5.95%, 7.40%, and 9.95% the structure has a legal final of 2053 but an anticipated repayment in April 2028 (with step-up mechanics if not refinanced).

- Ting’s 2024 securitization added $79m total ($55m at 5.63%, $8m at 6.85%, $16m at 9.15%) with anticipated repayment in August 2029 (again, step-up if not refinanced).

- Ting’s Series A preferred was initially funded with $60m in August 2022 further milestone funding availability expired unused in August 2025. The preferred return is 15% (adjustable 13%–17%) and compounds quarterly it also carries “mandatory redemption” triggers including a sale of Ting.

Then came the red flag: Ting missed two quarters of preferred return payments, totaling $9.5m as of Sept. 30, 2025, and received notice that this would become a “Return Breach” if not cured. On Dec. 1, 2025, Ting received written notice asserting a Return Breach/Trigger Event had occurred the filing states that if Ting received a redemption request, the estimated redemption price would be ~$186m.

This matters for “post‑Ting” strategy because it shapes the sale math. A buyer can’t just “pay up” for the subscriber base they must either (a) assume and refinance the ABS stack on a tight clock, and (b) negotiate around the preferred redemption economics, or the asset becomes a forced-seller story.

Operationally, Ting is not collapsing – it is improving. At year-end 2025 Ting reported 53.9k subscribers under management and a mix shift toward partner markets. Capex intensity has already been cut hard: Ting “fiber capital expenditures – consumption” fell to $10.7m in 2025 from $40.5m in 2024. That is the kind of change you make when capital is rationed and exit options are being prepared.

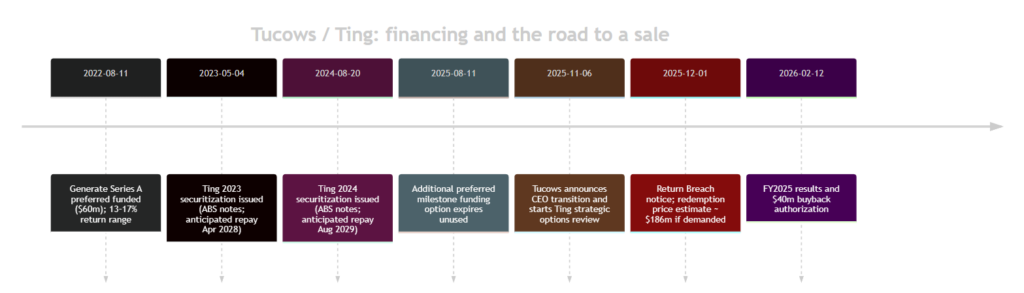

A timeline helps show why this is now urgent, not theoretical.

The post-Ting strategy is clear execution choices are not

The strategic pitch from new CEO David Woroch is straightforward: once Ting is resolved, Tucows aims to run a leaner, capital-light parent and use capital flexibility to build or buy “platform” businesses. The CFO Ivan Ivanov framed it even more practically: Ting has constrained cash deployment for years post‑Ting, they want the remaining businesses to translate operating performance into free cash by controlling capex and working capital.

The debate is not “what business are we?” It is “what do we do first with limited clean capital?” Here are the real post‑Ting options, with the trade-offs that matter:

Debt paydown first – Tucows (excluding Ting) carries a Canadian bank syndicated facility – ~$189.6m debt with maturity Sept 2027. The revolving credit facility has covenants (leverage and interest coverage), and its pricing moves with leverage. Deleveraging buys flexibility – and in this rate world, flexibility is value.

Buy back stock, but don’t treat it like free money

Tucows authorized a new $40m buyback running Feb 2026–Feb 2027, funded from working capital and existing credit facilities. With ~11.1m shares out and a deck-listed price of $18.61, that authorization can retire roughly ~2.15m shares (about ~19%), if fully used. That is meaningful. It is also aggressive for a company that still reports GAAP losses and carries leverage – so the pacing matters more than the headline.

Targeted M&A: plausible, but easy to get wrong Post‑Ting, Tucows would be two engines:

- Tucows Domains: high-margin, cash‑oriented, but currently dealing with normalization after a large reseller customer moved off platform – domains under management fell to 21.5m at year-end 2025 from 24.5m a year earlier.

- Wavelo: software with growth potential, but guidance already assumes uncertainty around Ting outcomes (because Ting is a platform customer).

M&A can help if it strengthens these two arcs (domains adjacency or telecom software scale) without importing new capex burdens. The risk is buying “a story” at a high multiple right when the core businesses are printing real cash.

Cost structure changes: the hidden third lever. Corporate Adjusted EBITDA is guided at ($6m)–($9m) in 2026, primarily due to legacy mobile obligations and overhead. Some of the mobile-related purchase/commitment burden is explicitly time-bound (e.g., minimum revenue commitments through early 2026 in certain contracts). If Tucows wants to be valued like a steady cash compounder, it has to stop letting “Corporate & Other” eat the story.

Scenarios and what they imply for cash and per-share outcomes

A key missing input is the one investors want most: the actual Ting sale price and structure. As of Feb. 18, 2026, Tucows has described an ongoing strategic process and has not disclosed a signed sale transaction for Ting.

So the only honest way to model “post‑Ting” is with conservative assumptions and clear labels. Assumptions used below (conservative):

- FY2026 Adjusted EBITDA excluding Ting: $55.5m midpoint of guidance.

- Buyback price: $18.61 (company deck reference point).

- Shares outstanding: 11.1246m (company disclosure).

- Corporate interest rate on the revolver: modeled at ~8% all‑in for rough savings math (variable-rate SOFR-based facility sensitivity disclosure shows +1% ≈ +$1.9m annual interest on ~$190m balance).

- “EPS effect” below is a cash EPS proxy (change in per-share earnings power), not GAAP EPS, because post-sale depreciation, taxes, and one-off items are unknowable without transaction docs.

| Scenario | Key assumptions | One-year parent cash impact | EPS / per-share earnings power effect (proxy) | Expected timeline |

|---|---|---|---|---|

| Base | Ting resolution in late 2026 with no material cash proceeds to parent (buyer assumes Ting stack parent mainly benefits from removal of Ting drag/complexity). Execute existing $40m buyback. | ($40m) deployed to repurchase ~2.15m shares | Share count drops ~19% → per-share earnings power mechanically rises ~+24% (same dollar earnings spread over fewer shares). | Buyback over 12 months “clean” post‑Ting reporting likely 2027 once deal closes and financials restate |

| Upside | Ting resolves sooner and parent receives $75m net cash (after fees/clean-up). Use $40m for buyback + $35m for debt paydown. | ~$0 net (sale proceeds recycled into buyback + deleveraging) | Buyback effect (~+24%) plus interest savings ~$2.8m/yr (8% on $35m) → add ~$0.31/share after the share count drops. | 6–18 months (deal + capital return pacing) |

| Downside | Ting resolution slips into 2027 legal/financing friction (preferred remedies, staged asset sales) absorbs time. Tucows prioritizes covenant headroom and executes only $10m of buyback. | ($10m) | Shares down ~5% → per-share uplift only ~+5% narrative discount persists. | 18–30 months risk of distraction into 2028 ABS refinance window remains |

Two practical takeaways fall out of this table.

First, the buyback is not cosmetic. At current scale it is potentially a “change-the-denominator” move – if Tucows can actually fund it without choking covenant flexibility.

Second, the upside case is not “Ting sells for a big multiple.” The upside case is “Ting exits cleanly, and even modest parent proceeds are deployed into debt + shares fast.”

What to watch, and what to do now

The post‑Ting Tucows story lives or dies on a handful of measurable, non-glamorous items. The key isn’t press commentary it’s documents. Watch for an 8‑K with sale terms, treatment of Ting ABS debt, and how the preferred holder Generate TF Holdings, LLC is handled – especially given the ~$186m redemption-price estimate if redemption is demanded.

The corporate facility is covenanted and floating-rate. At Sept. 30, 2025, leverage and coverage were in compliance (2.97x leverage 4.20x coverage). At year-end management also described itself as in compliance. If buybacks raise leverage, that cushion matters.

Domains concentration and “expiry” dependence

Domains under management dropped sharply to 21.5m in 2025, and management linked the move to a large customer taking registrations in-house – this is a reminder that wholesale scale is rented, not owned. At the same time, margin strength benefited from elevated expiry stream sales, which management expects to moderate in 2026 (Domains EBITDA guide $47m–$49m).

Wavelo customer risk (and the Ting paradox)

Wavelo is guided down in 2026 ($14.5m–$15.5m) partly because guidance explicitly accounts for a range of outcomes for Ting subscribers currently on the platform. The post‑Ting plan must therefore include a commercial plan: either keep Wavelo embedded with the divested Ting, or replace that revenue cleanly.

Capital allocation discipline

Tucows’ own investor deck shows unlevered free cash flow swung to +$32.4m in 2025 after being negative for several years. That is the raw fuel for buybacks and debt paydown – if the company does not light it on fire with expensive deals.

Kamil Kołosowski

Author of this post.