TL;DR – if 2024 was about post‑COVID normalization, 2025 was about pressure – on margins, positioning, and on the long‑term credibility of the traditional shared hosting model.

Growth didn’t collapse, but cracks became visible, and for the first time in years, they were openly discussed by operators and investors alike.

This article is our take on what actually mattered in 2025 for shared hosting, stripped of hype, noise and wishful thinking.

1. The market didn’t shrink, only segmented further

Shared hosting volumes stayed broadly stable in 2025, but the composition of customers changed noticeably.

According to aggregated market data, shared hosting still accounted for ~37-38% of the global web hosting market in 2025 (by WPressBlog.com), down from ~41% in 2022, while VPS and cloud hosting continued to outgrow it in both revenue and new deployments.

Key behavioral shifts observed in 2025:

- price-sensitive users showed higher churn, particularly on entry-level plans,

- SMB customers remained, but increasingly demanded better performance guarantees and automation,

- new site creators often bypassed direct purchase of hosting entirely, choosing AI-driven builders or SaaS platforms.

Multiple webhosting.today articles published in 2025 highlighted declining new shared hosting sign-ups across mature markets, while upgrades to VPS and managed WordPress plans increased. It’s a visible signal of internal segmentation rather than market collapse.

For providers, this meant that scale alone stopped being a sufficient strategy.

Monetization, better upsell and crosssell logic as well as cost discipline mattered more than raw account numbers.

https://webhosting.today/2026/01/23/ionos-how-to-do-cross-sell-on-shared-hosting-without-selling-bs/

2. AI stopped being a feature and became a substitute

In previous years, AI in hosting was mostly cosmetic: chatbots, content generators, basic site assistants.

In 2025, AI crossed started replacing entire workflows that previously were important part of shared hosting:

- website creation without WordPress,

- no database, no FTP, no cPanel,

- zero maintenance mindset.

Market research cited by webhosting.today in 2025 showed AI-powered website builders reaching tens of millions of active users globally, with some platforms reporting that over 30% of new websites were created without traditional CMS or hosting access.

Hosting providers themselves increasingly marketed AI builders as primary entry products, not add-ons.

This shift visibly reduced the role of shared hosting as the default entry point to the web.

3. Investors showed that they do not like the uncertainty

Public markets sent a clear signal in 2025: AI is viewed as a structural risk to traditional software and hosting-adjacent businesses.

In 2025 earnings calls and investor materials, companies such as GoDaddy, Wix and Squarespace increasingly emphasized AI-driven efficiency, cost control and retention, rather than raw customer growth.

Valuation multiples across publicly traded web infrastructure companies went down compared to 2021-2022 levels, reflecting uncertainty around long-term defensibility. We wrote about GoDaddy losing around 40% of its valuation in 2025, as well as opinions that Newfold lost over 1 million subscribers (roughly 17%), with a large part in 2025.

For shared hosting operators, especially those owned by private equity or preparing exits, this translated into:

- higher pressure on predictable, recurring cash flow,

- reduced tolerance for speculative “AI-first” narratives.

AI had to either raise ARPU or lower operating costs to be taken seriously by investors.

4. M&A activity stayed high

2025 was another strong year for hosting-related M&A, but the logic behind deals evolved.

Based on webhosting.today’s deal tracking, dozens of hosting-related acquisitions were announced or closed in 2025, with the majority involving regional providers,SaaS companies, niche platforms or infrastructure-focused assets rather than mass-market shared host.

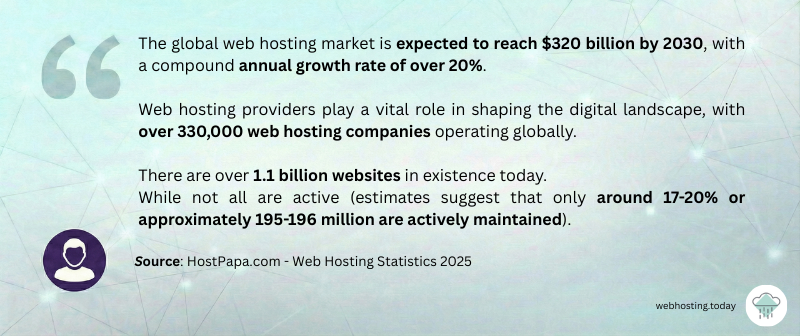

The global hosting market remains highly fragmented, with 300,000+ active hosting providers worldwide, naturally driving consolidation. However, most 2025 transactions were motivated by:

- geographic density and operational overlap

- cost synergies and platform unification

- access to billing, automation or provisioning IP

- teams and expertise rather than consumer-facing brands

5. Infrastructure discipline became a competitive advantage

While marketing narratives focused on AI, the best-performing hosting companies in 2025 did something reasonable:

- optimized hardware refresh cycles,

- reduced support load through smarter defaults,

- simplified product portfolios,

- invested in internal tooling rather than surface-level features.

Customer research referenced by webhosting.today showed that performance, uptime and reliability were cited by over 90% of buyers as primary decision factors in 2025, far outweighing interest in experimental features.

6. Shared hosting matured further

Despite pressure from cloud platforms and AI-driven builders, shared hosting still represented over one-third of all hosting services sold globally in 2025, and continued to generate stable recurring revenue for most large providers.

Shared hosting can be really profitable, but only when operators:

- stop chasing every trend,

- clearly define their core customer,

- accept that not every website needs to be theirs.

The companies that internalized this reality in 2025 are entering 2026 leaner, calmer and structurally stronger.

Damian Andruszkiewicz

Author of this post.