In a year marked by dynamic shifts in the tech landscape, Verisign’s operations in 2023 showcased resilience and adaptability. As a critical backbone of internet infrastructure, the company navigated through challenges and changes, maintaining its commitment to providing reliable, secure domain services. This analysis delves into Verisign’s financial health, strategic moves, and future outlook, offering insights without leaning towards adulation or endorsement.

Financial overview

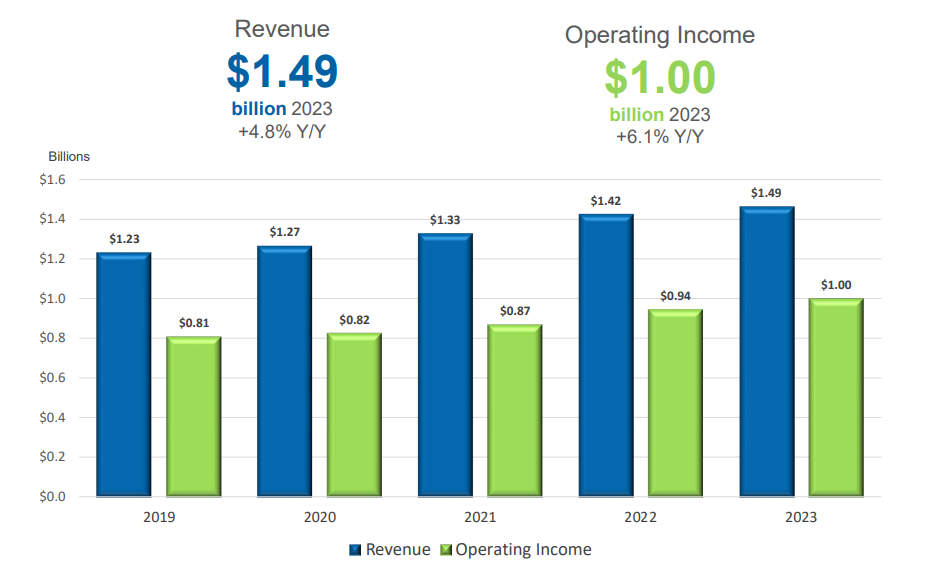

Verisign’s financial performance in 2023 reflected its robust business model and efficient management. The company reported a steady revenue increase, highlighting its ability to generate sustainable income amidst varying market conditions.

The company generated revenue of $380 million in the fourth quarter, up 3.0% compared to the same period in 2022. Operating income was $256 million and net income was $265 million, which translated into earnings per share (EPS) of $2.60. For the full year, revenue rose 4.8% to $1.49 billion, and net income reached $818 million (EPS of $7.90).

Owned base of maintained domains

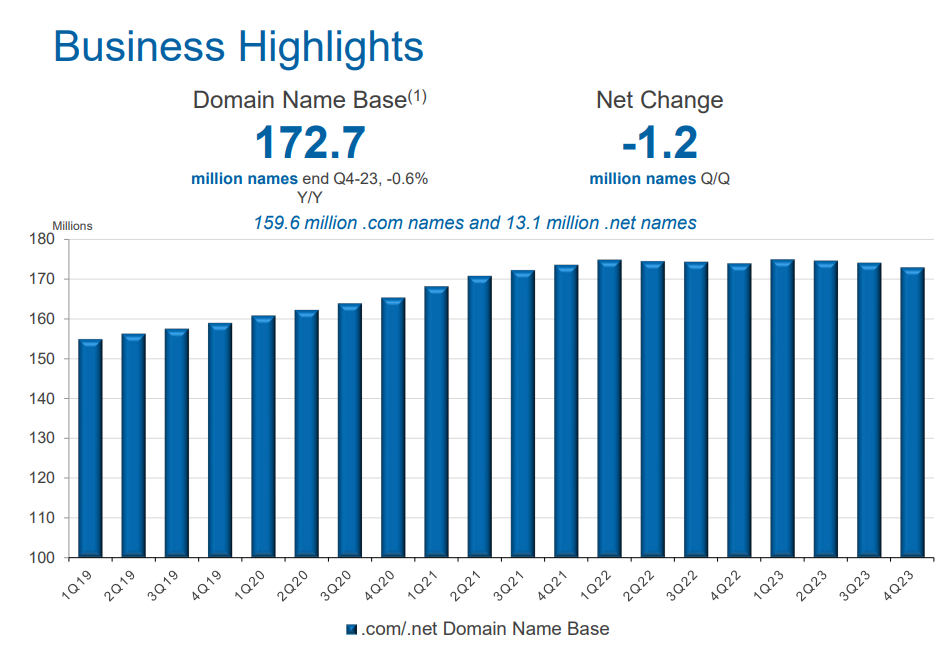

In 2023, Verisign navigated through various challenges and opportunities within the domain registration market. Here’s a closer look at the company’s performance in terms of its domain name base, new registrations, and renewal rates:

1. Domain Name Base: Verisign reported a domain name base of 172.7 million, marking a decrease of 1.2 million domain names quarter-over-quarter. This total includes 159.6 million .com domains and 13.1 million .net domains, reflecting the vast scale of Verisign’s operations in managing two of the internet’s most critical top-level domains.

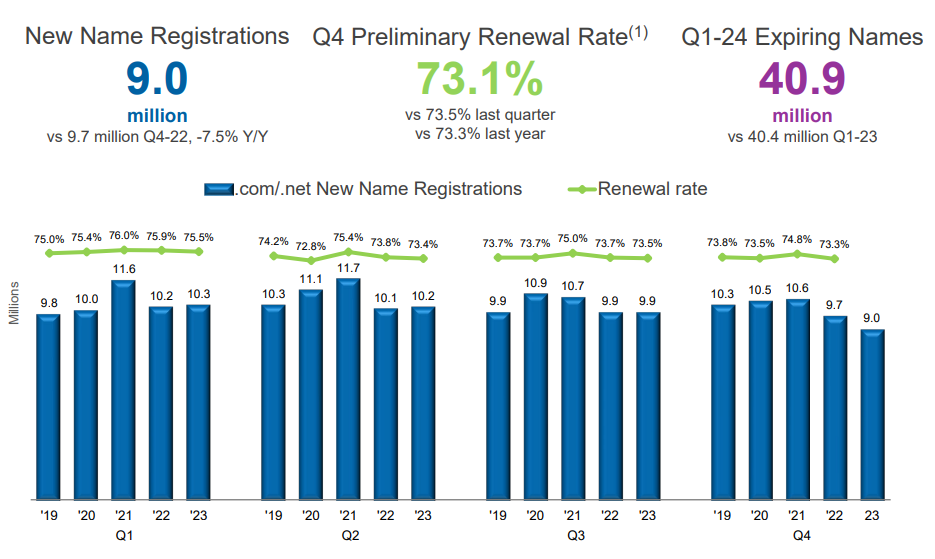

2. New Registrations: The company observed new registrations totaling 9.0 million, which represents a decline of 7.5% year-over-year compared to 9.7 million in the fourth quarter of 2022. This decrease indicates fluctuating market demand for new domain names amidst evolving digital landscape trends.

3. Preliminary Renewal Rate: The preliminary renewal rate for domain names stood at 73.1%, slightly down from 73.5% in the previous quarter. This marginal change suggests a consistent level of customer retention and trust in Verisign’s domain registration and renewal services, despite the slight decrease.

Reconciliation of adjusted EBITDA and Free Cash Flows for 2023

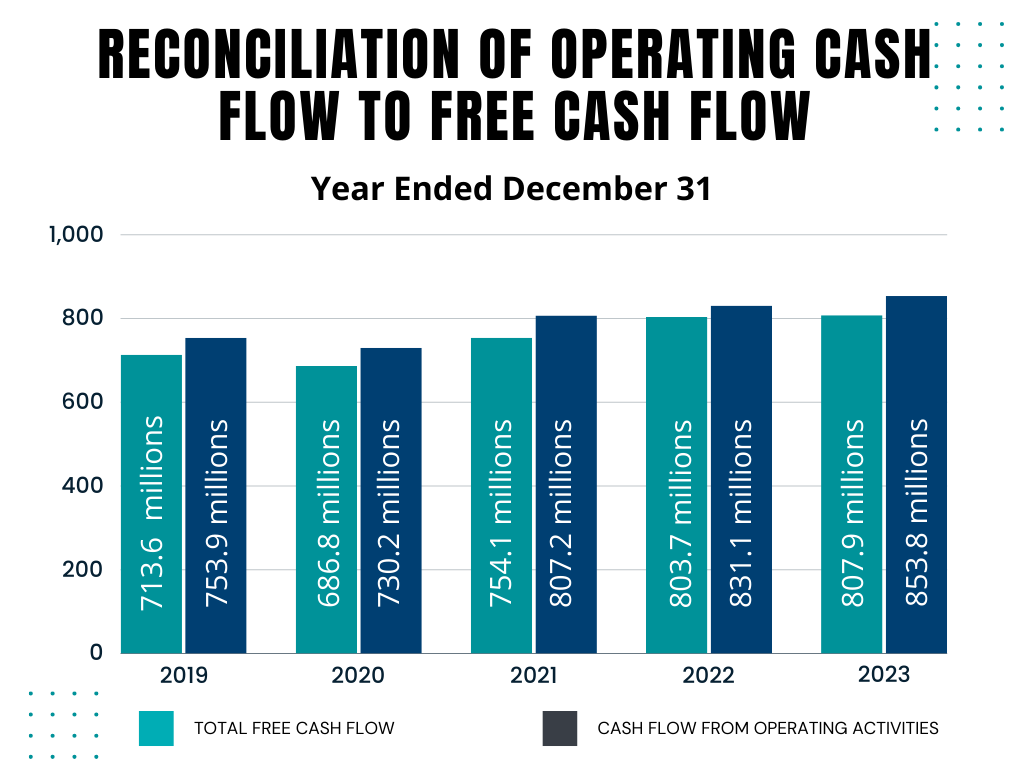

In 2023, Verisign provided a detailed financial reconciliation, highlighting the transition from GAAP net income to non-GAAP financial measures, specifically adjusted EBITDA and free cash flows. This reconciliation offers insights into the company’s operational efficiency and financial health beyond the standard accounting metrics.

- Adjusted EBITDA: Verisign reported an adjusted EBITDA of $1,166.6 million for the year ending December 31, 2023. Adjusted EBITDA, a non-GAAP financial measure, provides a clearer view of the company’s operational profitability by excluding non-operational expenses such as interest, taxes, depreciation, and amortization, as well as certain non-recurring items. This figure is essential for understanding the core operational performance and financial strength of Verisign.

- Free Cash Flows: The company also reported free cash flows of $807.9 million for the same period. Free cash flow, another crucial non-GAAP metric, represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. This figure is a vital indicator of Verisign’s ability to generate cash from its operational activities, which can be used for investments, debt repayment, dividends, and share repurchases.

The reconciliation from GAAP net income to adjusted EBITDA and free cash flows provides stakeholders with a deeper understanding of Verisign’s financial performance, highlighting the company’s ability to generate profit and cash flow from its core operations. This detailed financial analysis underscores Verisign’s operational efficiency and its capacity to sustain and invest in its growth while returning value to shareholders.

Looking ahead

As we look ahead to 2024, Verisign has outlined its expectations for the year, providing insights into anticipated performance metrics across several key areas. Here’s an overview of the company’s forecasts:

1. Domain Base Growth: Verisign projects a modest fluctuation in its domain base, with anticipated growth ranging from a decrease of 1.0% to an increase of 1.0%. This projection reflects the company’s cautious optimism in the face of market variability and the evolving digital landscape.

2. Revenue: The company expects revenue to be between $1.560 billion and $1.580 billion for the full year. This forecast suggests a continuation of Verisign’s steady financial performance, driven by its core domain registration and renewal services.

3. Operating Income: Operating income is forecasted to be in the range of $1.045 billion to $1.065 billion. This indicates Verisign’s focus on maintaining operational efficiency and profitability amidst its growth initiatives and market challenges.

4. Capital Expenditures: Verisign anticipates capital expenditures to be between $35 million and $45 million. This investment underscores the company’s commitment to enhancing its infrastructure and technological capabilities to support its services and future growth.

5. Effective Tax Rate: The company projects an effective tax rate of 21% to 24% for the year. This range reflects Verisign’s financial planning in the context of its operational and strategic investments.

These forecasts for 2024 highlight Verisign’s strategic planning and financial outlook, emphasizing its cautious yet optimistic approach to navigating the upcoming year. With a focus on balancing growth with operational efficiency and financial stability, Verisign aims to continue its role as a key player in the internet infrastructure sector.

Conclusion

Verisign’s performance in 2023 illustrates a company adept at navigating the complexities of the internet infrastructure sector. By maintaining a delicate balance between operational excellence, financial health, and strategic foresight, Verisign is poised to continue its legacy of reliability and security. As the digital world continues to expand and transform, Verisign’s role remains ever crucial, ensuring the stability and resiliency of the internet for businesses and users worldwide.