The domain name industry continues to evolve dynamically, with the second quarter of 2024 presenting key trends and statistics crucial for domain investors, businesses, and digital marketers. According to the latest DNIB Quarterly Report, domain name registrations have reached significant milestones, providing insights into the health and direction of the global domain market.

Total domain name registrations

As of Q2 2024, the total number of domain name registrations stood at 362.4 million, reflecting a stable market compared to Q1 2024. This stability is noteworthy amidst the fluctuating digital landscape. On a year-over-year basis, domain registrations have increased by 5.8 million, marking a 1.6% growth.

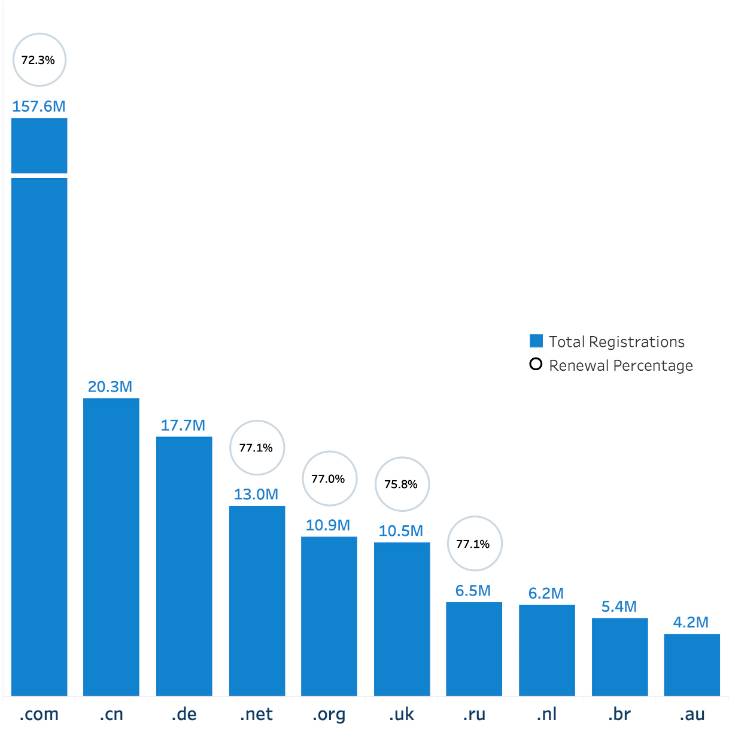

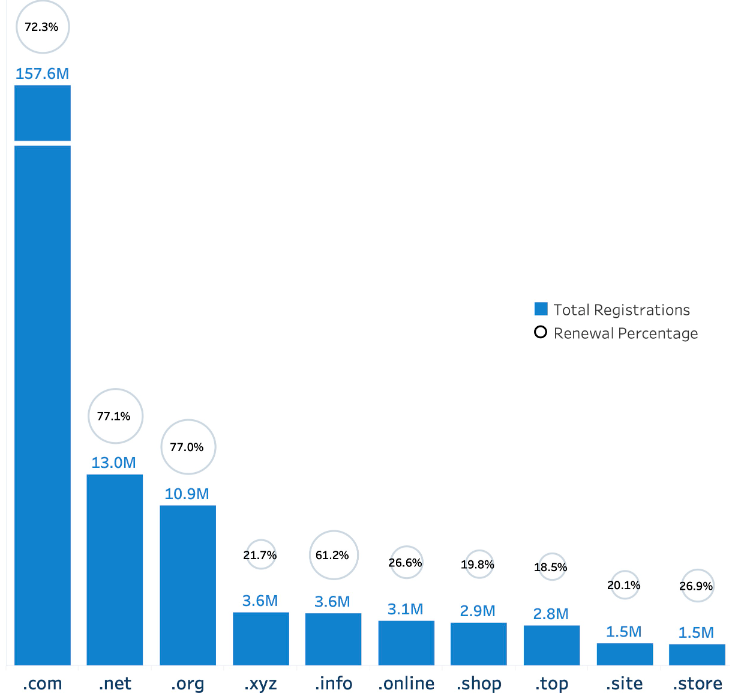

The .com and .net TLDs dominate the landscape with a combined total of 170.6 million registrations, despite a slight decrease of 1.8 million from Q1 2024. The .com TLD alone boasts 157.6 million registrations. However, new .com and .net registrations dropped to 9.2 million in Q2 2024 from 10.2 million in Q2 2023. The renewal percentage for these TLDs is approximately 72.6%.

Country-Code TLDs (ccTLDs)

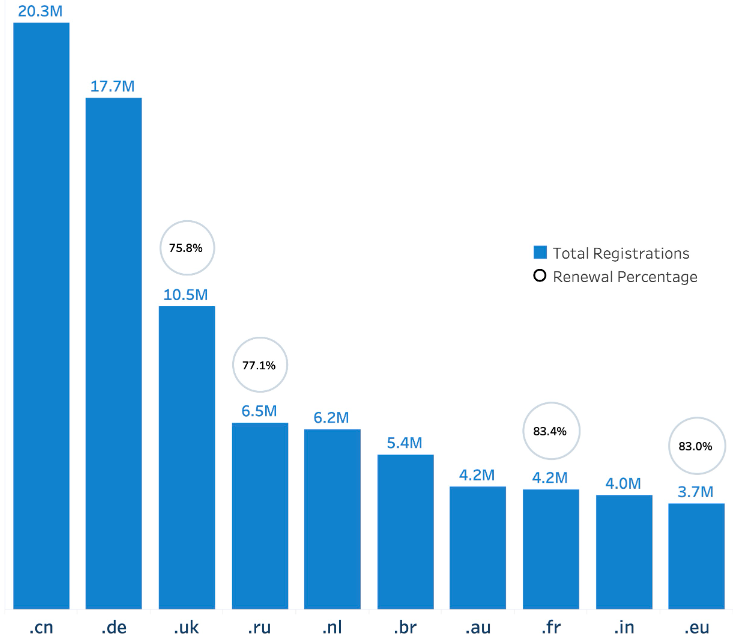

ccTLDs showed moderate growth, totaling 140.0 million registrations in Q2 2024. This represents a quarterly increase of 0.3% and a yearly increase of 2.2%. The data reveals that ccTLDs are becoming more prominent, especially in regions focusing on national digital identities and local SEO advantages.

New generic TLDs (ngTLDs)

New gTLDs have exhibited substantial growth, with registrations reaching 34.6 million in Q2 2024, a 4.0% increase from Q1 2024. On an annual basis, ngTLDs have surged by 23.2%, illustrating the growing interest in these alternative domain extensions. The renewal percentage for ngTLDs is estimated at 38.0%, indicating a significant churn rate but also reflecting the dynamic nature of this segment.

Other legacy gTLDs

Legacy gTLDs, excluding .com and .net, accounted for 17.2 million registrations, showing a slight increase of 0.7% from Q1 2024. The yearly growth for these TLDs is modest at 0.9%, with a renewal percentage of 71.8%.

Final thoughts

The second quarter of 2024 underscores the resilience and growth potential within the domain name industry. As digital transformation continues globally, understanding these trends helps stakeholders make informed decisions about domain investments, digital branding, and online strategies. In light of the data presented, it is evident that the domain name industry is not only stable but also poised for significant transformation. One compelling thesis that emerges from this analysis is that the diversification and localization of domain registrations are becoming pivotal for digital success.

Strategic imperative 1: embrace diversification

With the rise of new gTLDs and the increasing registrations in ccTLDs, businesses and investors should diversify their domain portfolios. The data indicates a robust interest in alternative domain extensions, which can provide unique branding opportunities and enhance online presence. By investing in a variety of TLDs, companies can capture a broader audience and mitigate risks associated with over-reliance on a single domain type.

Strategic imperative 2: leverage localized domains

The growth in ccTLD registrations signifies a shift towards localized digital identities. Businesses targeting specific geographic markets should consider acquiring relevant ccTLDs to boost local SEO performance and establish trust with local customers. This strategy is particularly advantageous in regions with high internet penetration and growing e-commerce activities.

Strategic imperative 3: focus on renewal rates

Renewal rates are a critical indicator of domain name value and stability. Stakeholders should pay close attention to the renewal percentages of different TLDs to make informed decisions about their domain investments. Higher renewal rates, as seen in legacy gTLDs and certain ccTLDs, suggest sustained value and user commitment, making these domains more attractive for long-term investment.

The domain name industry is at a crossroads, where traditional domains like .com still hold significant value, but the emergence of new gTLDs and the increasing importance of ccTLDs signal a shift towards a more diverse and localized digital landscape. By understanding these trends and adopting a strategic approach, stakeholders can maximize their domain investments and stay ahead in the competitive digital marketplace.

The future of domain names lies in embracing change and leveraging the unique opportunities presented by both new and traditional TLDs. As digital transformation accelerates, those who adapt and diversify will be best positioned to thrive in this evolving industry.

Kamil Kołosowski

Author of this post.