ICANN recently released the latest .com domain data from Verisign, covering August 2024. This data highlights trends in domain registrations and management across major registrars. Here are the key points from the report.

Key takeaways

Squarespace faced a significant year-over-year decline in domains under management (DUM), which can be attributed to the transition period following its acquisition of Google Domains in August 2023. The integration process may have caused disruptions or customer migration.

Gname did not feature in the list of new registrations for August 2024. However, the company still posted steady growth in its overall domains under management, indicating retention and possibly expansion through other channels.

Alibaba made a comeback on the monthly registrations leaderboard, marking a noticeable resurgence in new domain activity. This signals potential strategic moves or promotions within the Chinese market.

TurnCommerce saw a sharp decline in domains under management, shedding about 250,000 domains compared to the previous year. This shift allowed IONOS to surpass TurnCommerce, highlighting how fluctuations in renewals and acquisitions can reshape registrar rankings.

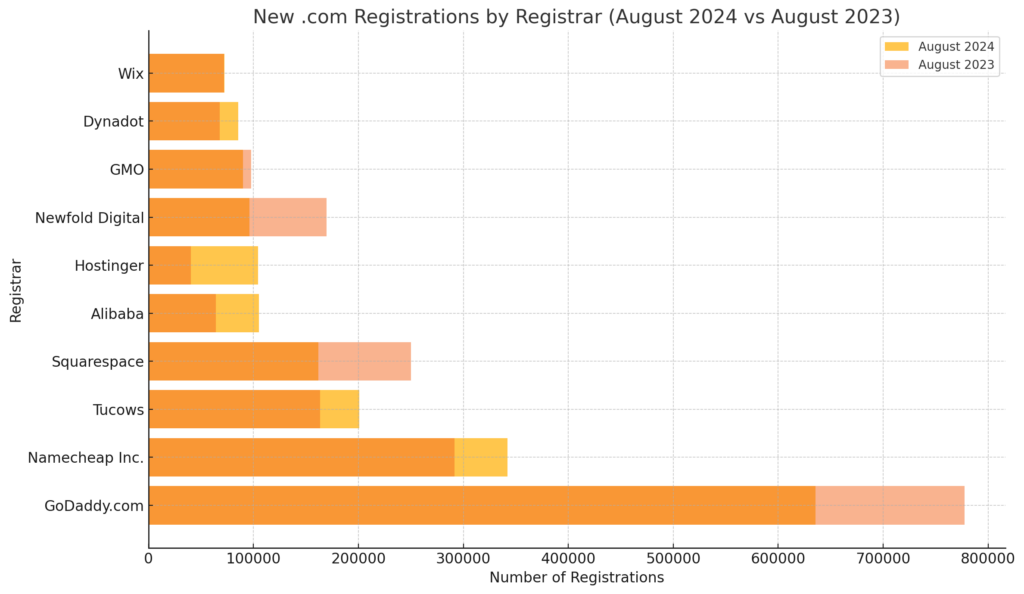

New .com registrations (August 2024)

Here’s how the largest registrars performed in terms of new .com registrations in August 2024. The rankings include registrars with multiple accreditations:

- GoDaddy.com – 635,440 (777,466 in August 2023)

- Namecheap Inc. – 342,193 (291,747)

- Tucows – 201,003 (163,629)

- Squarespace – 161,896 (250,324)

- Alibaba – 105,216 (64,138)

- Hostinger – 104,394 (40,547)

- Newfold Digital – 96,381 (169,663)

- GMO – 89,893 (97,747)

- Dynadot – 85,726 (67,750)

- Wix – 72,498 (71,825)

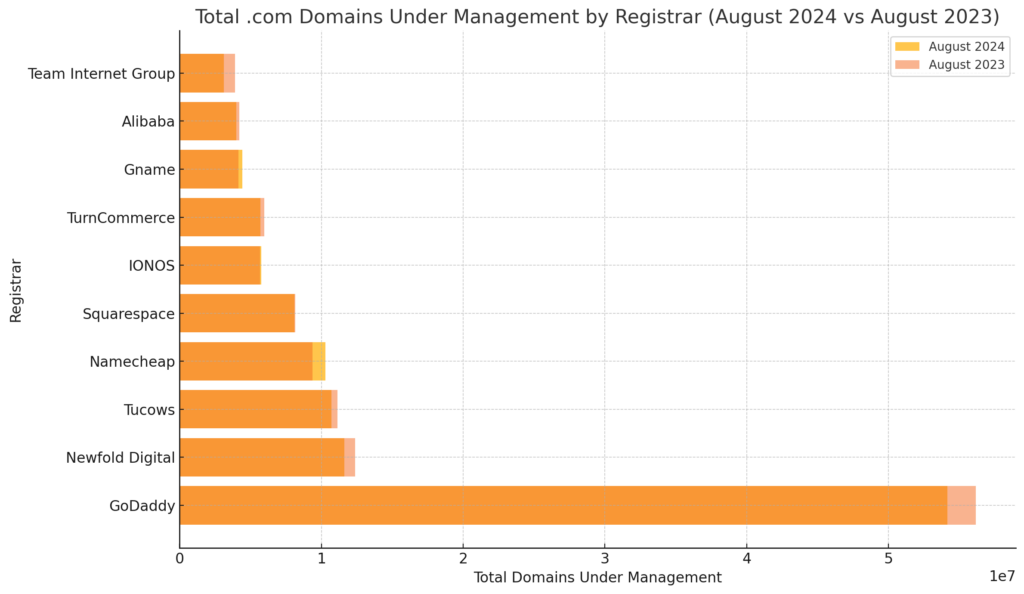

Total .com domains under management (August 2024)

The following are the top registrars based on total .com domains under management as of the end of August 2024:

- GoDaddy – 54,147,734 (56,170,439 in August 2023)

- Newfold Digital – 11,635,630 (12,370,532)

- Tucows – 10,722,268 (11,131,272)

- Namecheap – 10,284,896 (9,376,275)

- Squarespace – 8,087,961 (8,166,306)

- IONOS – 5,747,985 (5,659,585)

- TurnCommerce – 5,712,392 (5,958,992)

- Gname – 4,418,059 (4,155,354)

- Alibaba – 3,985,907 (4,213,654)

- Team Internet Group – 3,115,449 (3,910,648)

Registrar families breakdown

Many of the leading domain registrars manage a network of brands or have acquired other registrars over time. This consolidation helps them capture a broader market share and offer specialized services across different segments of the industry.

GoDaddy stands as the largest registrar family, with a collection of brands under its umbrella. In addition to its primary brand, GoDaddy also operates Wild West Domains, Uniregistry, and GoDaddy Corporate Domains. This diverse portfolio allows GoDaddy to serve a wide range of customers, from individuals and small businesses to large corporations requiring specialized domain services.

Namecheap has expanded its reach by managing Spaceship, a complementary service that targets users seeking affordable and streamlined domain registration options. This dual approach enables Namecheap to cater to both tech-savvy users and those new to the domain registration process.

Tucows owns multiple registrar brands, including Enom, Ascio, and EPAG. This multi-brand strategy positions Tucows as a key player in wholesale domain registration, reseller services, and direct domain sales. The variety of brands under Tucows ensures they cover a broad spectrum of customer needs.

Newfold Digital has built its registrar network through the acquisition of several established brands. Their portfolio includes Domain.com, Register.com, Network Solutions, and SnapNames, among others. This wide array of services allows Newfold Digital to offer domain registration, web hosting, and aftermarket domain sales.

Squarespace made a significant move by acquiring Google Domains, a transition that integrated a substantial number of domains under its management. This acquisition has expanded Squarespace’s market influence, allowing it to offer seamless domain services alongside its website-building platform.

IONOS operates under a multi-brand structure that incorporates 1&1, Cronon, and other smaller registrars. This structure enables IONOS to serve different segments, from personal domain holders to enterprise clients requiring complex domain solutions.

TurnCommerce focuses heavily on domain acquisition and aftermarket sales, with NameBright and DropCatch as key brands in its portfolio. This specialization allows TurnCommerce to dominate in domain backordering and resale markets.

Team Internet Group manages a variety of brands, including Key-Systems, Moniker, and other domain registrars. This diversity allows Team Internet to offer domain registration and hosting solutions across different markets and regions.

This breakdown highlights the competitive nature of the domain registration industry, where larger companies continually expand their networks through acquisitions and brand diversification. These insights provide a snapshot of the evolving domain registration landscape, reflecting competition and consolidation in the market.

Kamil Kołosowski

Author of this post.