The readers of this blog will be familiar with businesses like team.blue, group.one, Miss Group, IONOS, WebPros and others.

They all have one thing in common: Private Equity (PE) ownership.

When it comes to technology buyouts, PE firms tend to steer clear of businesses with SME exposure. It is not surprising. ACVs are low. Churn rate is high. Pricing power tends to be weak.

There is an one crucial exception to this rule: web hosting, or what is euphemistically called “online presence”. Bucking the trend of weak deal flow in buyouts in general, in the last few years PE have poured billions into European web hosting aggregators. A typical platform life cycle looks something like this:

Step one, an entrepreneur or mid cap PE firm assembles a “starter set” of assets (think Triton / Dogado, Sandberg Capital / Webglobe, Accel-KKR / One.com). EBITDA multiples they pay tend to be in the single digits, reflecting the targets’ small size.

Step two, the business is bought by a larger platform backed by a Tier 1 PE investor like CVC, Cinven or HgCapital. They are known to pay double-digit multiples, 13-15x for strategic assets like Loopia or dogado.

Step three, after 4-5 years the PE investor exits the whole platform to a competitor, often retaining a minority stake. Having said that, given the compounding potential (as well as the dearth of reinvestment opportunities), increasingly, the incumbent sponsor prefers to remain in control – and partner with a long-term capital provider. Like a Canadian pension fund. These investors are comfortable paying high teens multiples as their cost of capital is below PE. We estimate that CPP paid 19x EBITDA for a minority stake in team.blue.

In this article we:

- Examine the PE investment thesis and value creation playbooks in web hosting

- Explain why team.blue is worth €5B

If you are interested in learning more, check out the 3-part series published on the Rollupeurope blog:

- Sweet Home Onlina! Our Take on the European Web Hosting Land Grab

- Will team.blue end up dominating European web hosting?

- Euro hosting wars Vol.3: can group.one catch up to team.blue?

The Private Equity value creation playbook

The playbook well trodden path with twists and turns that look surprisingly familiar from one industry to another. It has 3 key features:

One, a fast-paced but highly disciplined M&A strategy that targets two types of businesses:

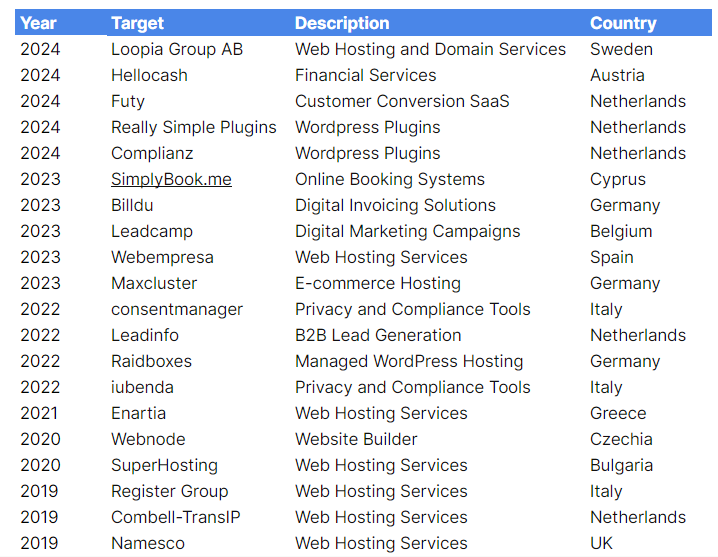

- Customer books – typically small, regional providers. As the Miss Group founder Mattias Kaneteg shared in a Linkedin post, his company prefers so-called local champions – businesses “that are already commanding their local market and have proven that they can grow quickly and sustainably”

- Add-on products and capabilities for upsell. Think privacy / cookie management, WordPress plugins, ecommerce solutions etc.

Two, an unrelenting focus on profitability and cash generation.

Team.blue, group.one and Miss Group are all running at 40-50% operating margins.

WebPros, a global web hosting automation software provider, which is a market with an unusually high share, is at nearly 60%. This compares to GoDaddy’s blended 2023 EBITDA margin of 27% (note that GoDaddy’s Applications & Commerce division delivered an EBITDA margin of 43% vs. 29% for Core Platform – which includes domains, hosting etc. revenue streams).

It is not just about accounting ratios. These businesses are cash flow machines. Moody’s ratings reports on group.one highlight two features:

- Negative working capital – due to prevalence of subscriptions with upfront payments

- Low capex requirements of c.5% of revenue

Three, an aggressive (but manageable) capital structure. Again according to the ratings agencies, at the end of 2023, group.one carried a ratio of gross debt to EBITDA of 6.5x (source) compared to 7x for team.blue (source). Being backed by a brand-name sponsor certainly matters. Possessing resilient, growing cash flows matters even more.

How come team.blue is worth €5B?

I would not want to pursue a software rollup strategy in a vertical of interest to HgCapital. Unfortunately, there are a few. Accounting. Payroll. Tax.

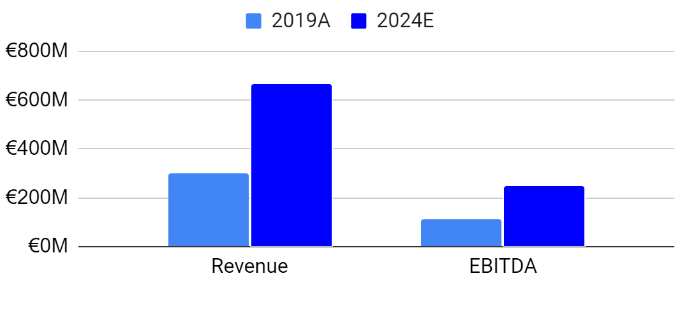

Turns out, also web hosting. Since 2019, Hg has owned team.blue (TB). We do not know whether Hg plans in 5-year increments. Either way, they shot the lights out with the first one. TB’s revenues and EBITDA are on track more than double between 2019-24, reaching €655M and €250M respectively, according to S&P.

In June, Hg announced that that the giant Canadian pension fund CPP Investments was buying into team.blue at a €4.8B enterprise value. Based on our estimates, this represents a 19x multiple of 2024E EBITDA.

The transaction is the outcome of an intense 7-year M&A spree which started with a 3-way merger (Combell Group, TransIP and Register Group) and followed by 20+ acquisitions of both hosting providers (i.e. clients) and products (mostly SaaS).

Such a rapid-fire M&A strategy would have been unthinkable without unrestricted access to debt financing. From studying S&P and Moody’s credit research reports we know that TB’s gross debt-to-EBITDA ratio has been in the 7-8x range. The ratio of its free operating cash flow (free cash flow minus debt service) to debt is only 4%.

And yet one look at TB’s Luxembourg filings reveals that the coupon it is paying on debt is far from distressed-like. The 3 senior loan facilities totalling just over €1B as at December 2023 (and about to increase to €1.3B following the Loopia acquisition) carry an interest of Euribor + 3.75%.

Following the recent Loopia acquisition, TB’s gross debt is forecast to reach almost €2B, according to S&P. How on earth has TB been able to pull it off? What is drawing blue-chip institutional investors like Invesco, Eaton Vance, GSAM and Guggenheim to this highly levered, SME-focused rollup?

Turns out lenders love TB’s combination of disciplined M&A strategy; robust organic growth; and standout cash conversion. But above all, they take comfort in Hg’s commitment, which manifests itself in the €1.4B equity cushion.

The flip side is that with so much capital invested, Hg will have to sweat the asset hard to generate the sort of returns that its limited partners have got used to.

At 15-20x 2024E EBITDA, TB is worth €4-5B. The Canadian pension fund CPP recently took a c.20% stake, valuing TB at the top end of this range (€4.8B).

Net of debt, this represents a c.2x MOIC to Hg. To get to 3x, EBITDA would need to increase by 50% from the current levels, assuming invested capital stays constant.

Given Hg’s track record, this does not strike me as a tall order.