Tucows is one of the most interesting companies in the domain market in my opinion. It has its own specificity. It is distinctive and has an idea for itself while not being afraid to take risks by undertaking many projects in its history (especially through successful acquisitions of other companies) that complement their core business.

As the second largest domain registrar in the world after GoDaddy while never seriously trying to compete with them 1:1 looking for its way through primarily successful projects such as OpenSRS.

Since its inception in 1993, Tucows has been at the forefront of the internet revolution, carving out a niche for itself in the domain registration and internet services sector. The company’s journey from a humble software download site to a global player in domain management is a testament to its resilience, adaptability, and strategic foresight.

In its formative years, Tucows began as a software distribution platform, offering users access to a wide array of shareware and freeware applications. This early foray into digital distribution laid the groundwork for Tucows’ future expansion into domain registration and internet services.

As the internet landscape evolved, Tucows recognized the burgeoning demand for domain registration services and seized the opportunity to diversify its offerings. Leveraging its established reputation and user base, Tucows transitioned into the domain registration business, establishing itself as a reliable and trusted registrar.

One of the pivotal moments in Tucows’ history came with its strategic focus on the reseller market. Understanding the power of partnerships and distribution networks, Tucows positioned itself as a leading wholesale domain registrar, catering primarily to resellers and domain service providers. This emphasis on the reseller channel proved instrumental in expanding Tucows’ reach and market penetration.

With a focus on the reseller market, Tucows has made significant strides by acquiring key players such as eNom and Ascio Technologies, solidifying its foothold in the industry.

The acquisition of eNom, for a substantial amount of $83.5 million, and Ascio Technologies ($29,44 million – 7,36x EBITDA) bolstered Tucows’ presence in the domain market, allowing it to tap into new customer segments and expand its service offerings.

When assessing domain renewals, Tucows consistently demonstrates a robust renewal rate of 79%, showcasing its unwavering commitment to customer satisfaction and retention. This figure not only exceeds industry standards but also reflects Tucows’ ability to consistently deliver value and maintain strong client relationships.

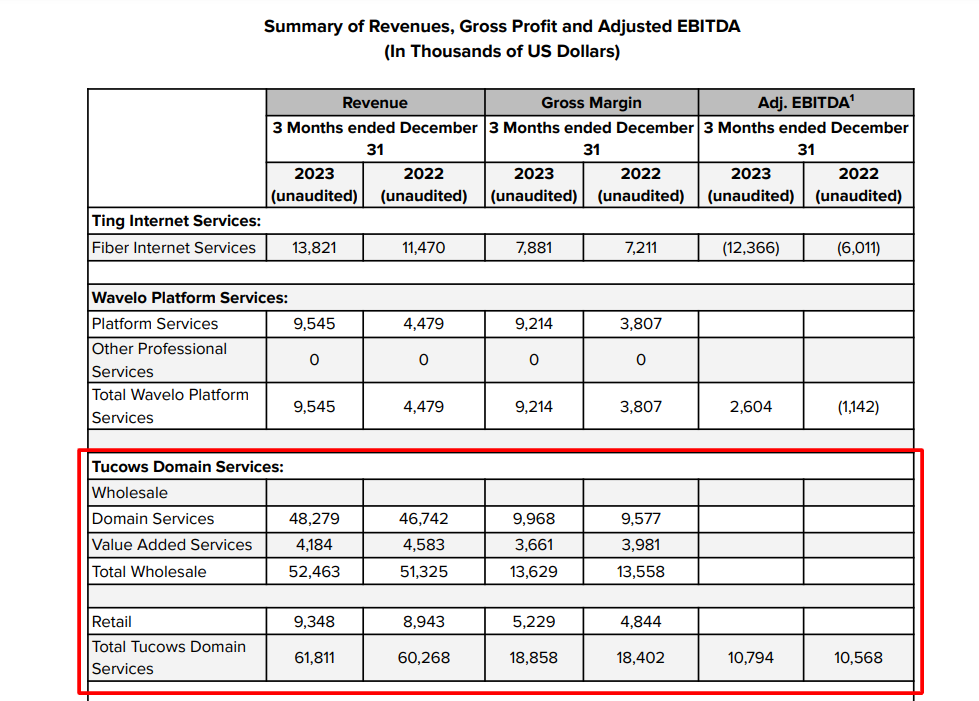

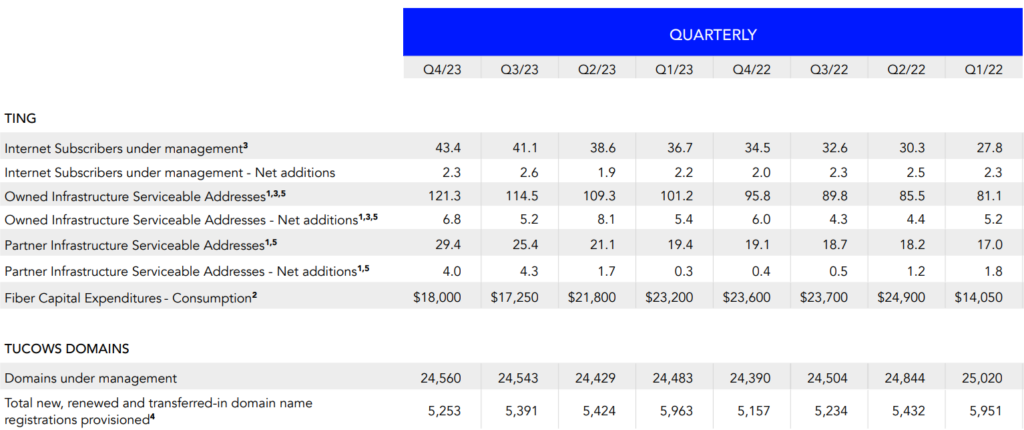

Delving into the financial metrics, Tucows’ fourth-quarter results for its domain services portray a positive trajectory. The company reported a total domain service revenue of $61.8 million vs GoDaddy’s $385 million, marking a significant 10% increase compared to the previous quarter. This notable growth highlights Tucows’ adeptness in capitalizing on market opportunities.

Moreover, Tucows exhibited an efficient customer acquisition process, evidenced by a customer acquisition cost (CAC) of $53 for the fourth quarter of 2023. This improvement in CAC signifies Tucows’ effectiveness in acquiring new customers and optimizing operational efficiency.

To illustrate the trend over time, let’s examine the comparison between the fourth quarter of 2023 and the preceding quarters:

| Quarter | Domain Service Revenue (USD) | Renewal Rate (%) | Customer Acquisition Cost (USD) |

| Q4 2023 | $61.8 million | 79% | $53 |

| Q3 2023 | $56.2 million | 78% | $58 |

| Q2 2023 | $54.6 million | 77% | $60 |

| Q1 2023 | $53.2 million | 76% | $63 |

An important open question remains that the increase in revenue is not necessarily related to an increase in the number of domains serviced or higher margins on resellers. In recent years, and especially throughout 2023, we may see a significant acceleration in the growth rate of domain maintenance prices on the part of registries which also translates into prices for resellers and end customers.

The reported Adjusted EBITDA of $10.8 million for Q4 marks a tiny uptick of 2.1% compared to the same period last year, underscoring Tucows’ resilience and ability to navigate evolving market dynamics. The outlined EBITDA guidance of $43 million for Tucows Domains in 2024 presents an ambitious target, indicative of the company’s confidence in its ability to drive sustained financial performance and value creation.

Interestingly – since the announcement of Q4 2023 results, Tucows’ share price has lost almost 20 percentage points. The consistent decline in Tucows’ stock price, currently hovering around levels last seen in 2016, underscores a concerning trend for investors. This stagnation, coupled with low growth dynamics, points to underlying challenges within the company’s operations. High indebtedness and subdued investor optimism towards the relatively low-profitability nature of the business could potentially be contributing factors to this downward trajectory.

Despite Tucows’ efforts to maintain a competitive edge and drive financial performance, the market sentiment appears to reflect skepticism regarding the company’s ability to generate sustainable returns. The limited upward momentum in share price suggests a lack of confidence among investors, potentially stemming from concerns surrounding Tucows’ profitability prospects and its ability to effectively manage its debt obligations. Looking at the share price, however, one should not forget that there are also other projects operating under the Tucows brand, which are not related to the domain registration market, and whose performance and prospects may affect the valuation on the stock market.

Lukasz Gawior

With nearly 20 years in the hosting industry, an expert in building and scaling hosting products. Founder of multiple hosting companies, involved in M&A projects and in creating software tailored to the needs of hosting providers.