GoDaddy’s Q2 2024 results show a company making strides in a competitive market. The strong performance in Applications & Commerce reflects the success of GoDaddy’s innovative strategies, particularly in AI and global expansion. However, while the company is gaining ground in new areas, there’s still room for improvement in boosting growth within its core hosting and domain services. As GoDaddy continues to build on its strengths, the challenge will be to ensure that these foundational areas also benefit from its forward-looking strategies.

GoDaddy posted a 7% year-over-year revenue growth, reaching $1.124 billion in Q2 2024. The Applications & Commerce (A&C) segment was a key driver, with a remarkable 15% increase in revenue to $406 million, compared to $352 million in Q2 2023. This growth was fueled by new product launches, aggressive pricing strategies, and a focus on bundled services that added significant value to customers.

The Core Platform segment, which includes domains, hosting, and security services, showed a modest 3% growth, generating $719 million. Although this segment’s growth was slower, it remains crucial, contributing 64% of GoDaddy’s total revenue. The stability of this segment underscores GoDaddy’s ability to maintain a solid foundation while expanding into higher-margin areas.

EBITDA Margin and Profitability: GoDaddy’s normalized EBITDA margin expanded to 29%, reflecting improved operational efficiency and cost management. This margin expansion is significant, considering the competitive pressures in the digital services market. The company’s focus on reducing friction in customer journeys and leveraging AI to enhance product offerings has played a critical role in achieving this profitability.

In Q2 2024, GoDaddy reported a free cash flow of $323 million, a substantial 35% increase from the $240 million in Q2 2023. This strong cash flow performance is a testament to GoDaddy’s disciplined capital allocation and effective cost control measures. The company’s ability to generate consistent cash flow underpins its long-term growth strategy and shareholder value creation.

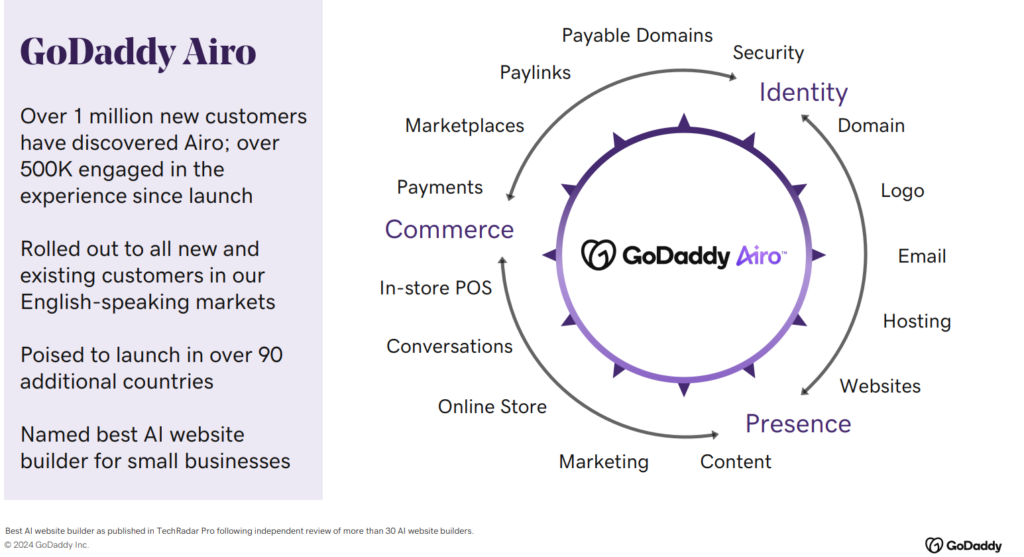

Strategic Initiatives: One of the standout initiatives in Q2 2024 was the continued rollout of GoDaddy Airo, an AI-powered website builder that has attracted over 1 million new customers since its launch. This tool not only enhances user experience but also positions GoDaddy at the forefront of AI integration in web services. The success of Airo highlights GoDaddy’s commitment to innovation, a key factor that contributed to the company’s soaring stock price earlier in 2024, as reported by webhosting.today.

GoDaddy also expanded its product bundling strategies, which played a crucial role in boosting the A&C segment’s performance. By offering seamless integration across its product suite, GoDaddy has been able to increase customer lifetime value and reduce churn rates, further solidifying its market position.

Performance of Hosting and Domains in GoDaddy’s Q2 2024

Core Platform Segment Overview:

- Revenue Contribution: $719 million, representing approximately 64% of GoDaddy’s total revenue.

- Growth Rate: The Core Platform, which includes hosting, domains, and security services, grew by a modest 3% year-over-year. This segment remains stable but is growing slower compared to the Applications & Commerce segment.

Domains and Aftermarket:

- Annualized Recurring Revenue (ARR): Core Platform ARR increased by 2% to $2.3 billion.

- Domain Performance: Domains continue to be a reliable revenue stream, but growth has slowed, reflecting market saturation and increased competition.

Hosting and Security:

- Revenue Trends: The hosting and security sub-segments, though stable, did not experience significant growth. The emphasis remains on enhancing the existing services rather than expanding aggressively.

- Profitability: Despite the slower revenue growth, GoDaddy improved its Core Platform’s EBITDA margin reaching 31%. This indicates better cost management and efficiency in these services.

GoDaddy’s strategy in hosting and domains focuses on maintaining a stable revenue base while pushing for higher-margin growth in other areas like Applications & Commerce. The company’s modest growth in these traditional services suggests a shift in focus towards more innovative and high-growth segments, such as AI-powered tools and enhanced commerce solutions. The hosting and domain market is increasingly competitive, with many players offering similar services. GoDaddy must continue to innovate within these segments to retain market share and drive incremental revenue growth. The company’s current approach suggests a balanced strategy of sustaining its core business while pursuing new opportunities in higher-margin segments.

Revenue Overview:

- Total Revenue: $1.124 billion (7% YoY growth)

- Core Platform: $719 million (3% YoY growth)

- Applications & Commerce: $406 million (15% YoY growth)

Profitability:

- Normalized EBITDA Margin: 29% (400 bps improvement)

- EBITDA: $332 million (25% YoY growth)

- Net Income: $146.3 million (13% net income margin)

Cash Flow and Shareholder Returns:

- Free Cash Flow: $323 million (35% YoY growth)

- Unlevered Free Cash Flow: $369 million (30% YoY growth)

- Share Buybacks: $3.1 billion in cumulative share repurchases, reducing outstanding shares by 23% since January 2022.

Key Metrics:

- Average Revenue Per User (ARPU): $210 (6% YoY growth)

- Total Customers: 21 million (stable YoY)

Debt and Liquidity:

- Net Debt: $3.42 billion

- Leverage Ratio: 2.4x (improved from 2.8x in 2022)

GoDaddy’s stock demonstrated notable volatility following the release of its Q2 2024 earnings on August 1, 2024, but ultimately showcased a strong recovery, driven by market reassessment of the company’s solid financial performance and strategic direction.

Earnings day stock market reaction (August 1, 2024)

- Opening Price: $146.07

- Closing Price: $141.41

- Percentage Change: -3.2%

On the day of the earnings release, GoDaddy’s stock initially dropped by 3.2%, closing at $141.41 from an opening price of $146.07. The stock hit an intraday low of $140.51, reflecting investor uncertainty or profit-taking, despite the company reporting strong financials, including a 7% year-over-year revenue increase.

Immediate recovery (August 2-5, 2024)

- August 2, 2024 Closing Price: $151.25

- August 5, 2024 Closing Price: $157.53

- Percentage Change (August 1 to August 5): +11.4%

Following the initial dip, the stock rebounded sharply, gaining 11.4% from the August 1 close to reach $157.53 by August 5. This quick recovery suggests that the market’s initial reaction was overly cautious, and investor confidence returned as they digested the earnings details more thoroughly.

Sustained Upward Momentum (August 6-13, 2024)

- August 6, 2024 Closing Price: $152.02

- August 13, 2024 Closing Price: $160.11

- Percentage Change (August 5 to August 13): +1.6%

From August 6 onward, the stock continued to gain momentum, closing at $160.11 on August 13, 2024. This represents a more moderate 1.6% increase from the August 5 close, indicating sustained investor optimism. Overall, from the post-earnings low on August 1, the stock increased by 13.2% to reach $160.11, reflecting a strong recovery and positive market sentiment.

Year-to-Date Context

- Price on January 1, 2024: $100.22

- Price on August 13, 2024: $160.11

- Year-to-Date Percentage Increase: +59.7%

Looking at the year-to-date performance, GoDaddy’s stock has surged by nearly 60%, from $100.22 on January 1 to $160.11 by August 13. This remarkable growth highlights the company’s strong execution of its strategic initiatives, including expanding its high-margin Applications & Commerce segment and rolling out innovative AI-driven products like GoDaddy Airo.

It’s unfortunate that GoDaddy has lost its edge in expanding its market share in hosting and domains, especially at a time when many other companies in the industry are achieving significant success in these areas. Despite its focus on innovation and growth in new segments, GoDaddy’s inability to strengthen its position in its traditional core services is a concerning trend.

Lukasz Gawior

With nearly 20 years in the hosting industry, an expert in building and scaling hosting products. Founder of multiple hosting companies, involved in M&A projects and in creating software tailored to the needs of hosting providers.